The team behind the Transparent Trade Coffee project is continuing to leverage its robust online research to explore ways in which specialty buyers may make more informed decisions that promote sustainability and stability throughout their supply chains.

In its latest “Insight” report, the TTC team — part of a social enterprise arm of the Emory University business school in Atlanta — presents something of a call to action to specialty coffee buyers toward transaction transparency, proposing that if more roasters are willing to open their books to some degree, then they would help lead the creation of a kind of transaction guide for other specialty coffee buyers.

“Many central players in specialty coffee markets want to move away from buying green specialty coffees based on current commodity price indices, so that quality, quantity and origin conditions can be recognized and rewarded,” TTC wrote in its latest insight. “Making this happen requires a broader commitment to collect, aggregate and disseminate more relevant pricing information based on more recent specialty coffee purchases.”

For now, TTC has conducted what it called “an extensive internet search” that revealed eight coffee roasters throughout the world with at least one published transparency report between the years 2014 to 2017. Those roasters — 49th Parallel, Barismo, Bird Rock, Counter Culture, Pact Coffee, Seattle Coffee Works, Temple Coffee, and Tim Wendelboe — published a combined 17 transparency reports in that time frame, with a combined 753 FOB (free on board) contract prices published.

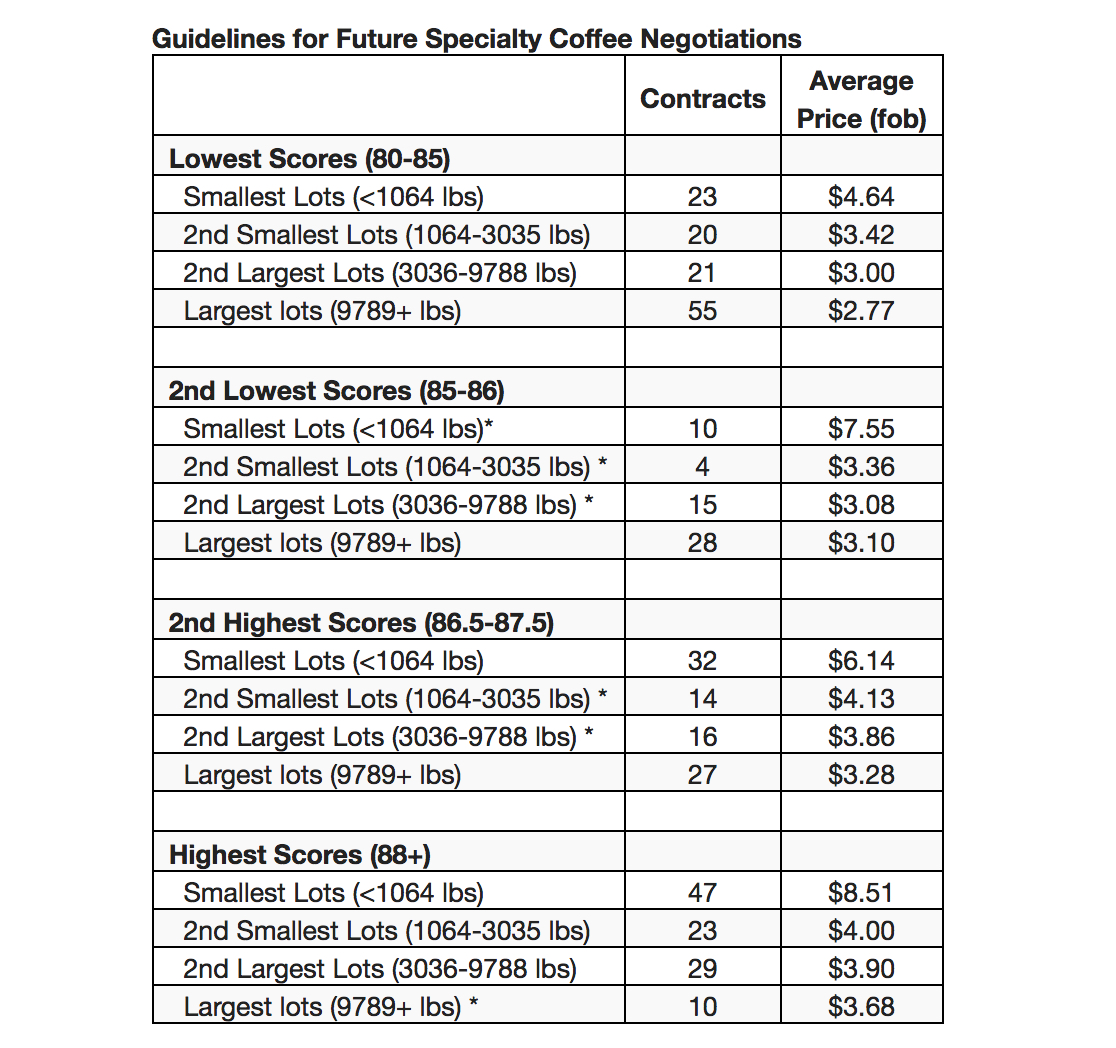

Read the TTC insight for more detail, but in short, the group’s analysis of the data pointed to three dominant factors affecting price: origin, quality, and lot size. The group also arranged the data to show that not only do all these factors matter, but that they are related, and support the idea that multi-tiered pricing schemes may be the way forward for buyers interested in obtaining a sustainable supply of quality coffee.

Keep in mind the remarkably small sample sizes in terms of both numbers of buyers and numbers of contracts, but look at how sensibly the TTC data lines up:

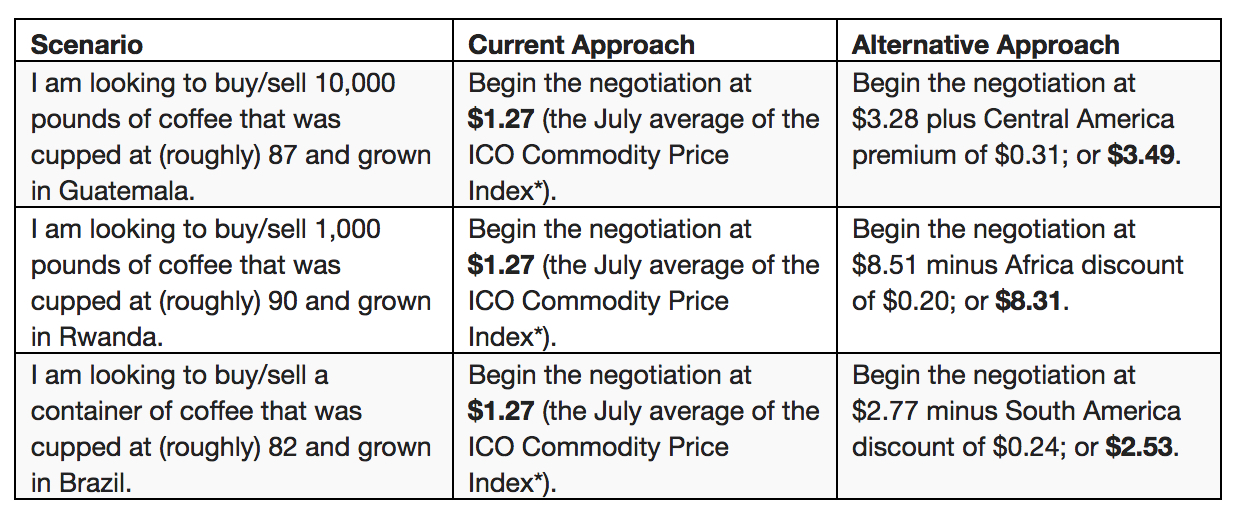

Taking this a step further, TTC provides an idea of how a coffee buyer’s transaction guide might look, again just based on this very limited sample size:

TTC, as its name implies, would naturally like to collect more data related to pricing transparency, potentially to create a more robust and practical transaction guide for buyers. The group is seeking “price data donors,” while noting that its existing numbers do not disclose information about individual contracts, and that simple non-disclosure agreements could be applied.

The group is seeking 20 to 30 more roasters and five to 10 more importers to help flesh out the potential guide.

“It becomes more relevant if these price data donors agree to provide comparable information about cupping scores and lot sizes for all coffees,” TTC wrote. “Finally, it becomes more useful if these price data donors also work to provide concise commentaries for other buyers and sellers who want to use the Guide to ground more appropriate specialty coffee price negotiations.”

Nick Brown

Nick Brown is the editor of Daily Coffee News by Roast Magazine.

Comment