After understanding the main concerns of South American coffee growers as the new harvest commenced in the middle of the COVID-19 pandemic, we now shift our attention to Central American and Mexican coffee producers.

During the last week of May 2020, our PECA team conducted a phone survey of 356 coffee growers from El Salvador, Guatemala Mexico and Nicaragua, all of whom sold coffee to us during the 2020 harvest. The objective of the survey was to understand how coffee growers in these four countries are coping with the pandemic, as well as to hear their views about the results of the 2020 crop and their current perspective on next year’s harvest.

Below you can observe the results of the survey:

Covid-19 Takes Its Toll

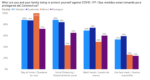

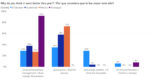

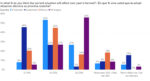

While opinions regarding how the 2020 harvest has been affected by the pandemic vary widely by country, there is an overwhelming consensus among growers that the pandemic will affect them in one way or another: 100% in Mexico, 97% in Nicaragua, 95% in El Salvador, and 84% in Guatemala.

Guatemalan and Mexican coffee growers seem to be the most optimistic — thanks primarily to the high prices received in the 2020 harvest, while El Salvadoran and Nicaraguan coffee growers are the most pessimistic — which were also the participants that considered that the 2020 harvest was not very good for them due to climate issues and low prices.

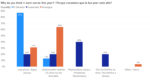

Regarding issues affecting them as a consequence of the pandemic, Nicaraguan farmers — the ones with the biggest average farm size — are mostly concerned about the lack of financing, which is mostly due to the political and economic crisis the country has been facing since April 2018.

Salvadorian and Mexican farmers — the ones with the lowest average farm sizes and therefore the ones with the lowest incomes — are mostly concerned about lack of money, with 35% and 44% of participants mentioning that as a concern. Guatemalan farmers mentioned a higher concern (57%) about movement restrictions affecting them. This is probably as a result of the tight curfews imposed by the Guatemalan government since mid-March, which are heavily affecting the supply of essential goods, as coffee farms in Guatemala tend to be remotely located from any major city.

In contrast with their South American peers, lack of labor is not a top concern amongst Mexican and Central American producers, most likely because the new harvest is still at least 6 months away.

How Are Growers Handling the Pandemic?

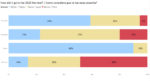

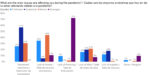

The good news is that the vast majority of coffee growers reported few COVID-19 cases in their communities, with Mexican farmers thankfully reporting zero infections in their communities. In addition, most coffee growers reported that they and their families are taking precautions to reduce the risk of infections.

In Mexico, the country that has the highest number of active cases of the four countries included in this survey, 100% of the coffee growers surveyed reported choosing to staying home, a measure that seems to be effective thus far. Meanwhile in Nicaragua, where the government has not imposed any lockdown measures or promoted social distancing, and where 14% of coffee growers reported cases in their communities, the second-highest percentage after El Salvador, coffee growers reported the lowest use of face masks and the lowest rate of staying home.

As we write these lines, the World Health Organization has warned that COVID-19 is now rapidly expanding in Latin America, despite many countries in the region enforcing tight lockdowns. Additionally, the World Bank has forecast that as many as 100 million people in emerging economies will be tipped into extreme poverty this year as shutdowns to tackle the disease are taking an increasing economic toll on these fragile economies. Economic activity in Latin America and the Caribbean is forecast by the Bank to contract by 7.2% this year, the biggest drop of all emerging economies.

It is clear that COVID-19 will leave long-lasting scars on coffee farmers in Latin America as with farmers in other coffee-producing countries, many who were already dealing with low coffee prices and adverse weather patterns.

The consequences that it will have on quality and farm productivity is potentially devastating for the specialty coffee industry. If there was ever a time to support coffee growers by paying good prices and forging long-term relationships, this is it!

Survey Information

- El Salvador: 75 growers from Chalatenango and Sonsonate with an average farm size of 6.2 ha.

- Guatemala: 90 growers from Chimaltenango, Chiquimula, El Progreso, Guatemala, Huehuetenango, Quetzaltenango, San Marcos, Solola and Zacapa, with an average farm size of 12.0 ha.

- Mexico: 98 growers from Chiapas and Oaxaca with an average farm size of 1.4 ha.

- Nicaragua: 93 coffee growers from Esteli, Jinotega, Madriz, Matagalpa and Nueva Segovia, with an average farm size of 32 ha.

[Editor’s note: A version of this story initially appeared on the Caravela Coffee website and it is republished here with permission. Daily Coffee News does not publish “paid content” or “sponsored content” of any kind. Any views expressed in this piece are those of the author and are not necessarily shared by Daily Coffee News.]

Alejandro Cadena and Alieth Polo

Alejandro is co-founder and CEO of Caravela Coffee, a quality focused green coffee exporter with operations in seven countries in Latin America and import companies in Australia, Europe and North America. Alieth Polo is the Regional PECA and Sustainability Director for Caravela Coffee. PECA is Caravela's grower education program, which provides education and technical assistance to more than 4,000 coffee growers.

Comment