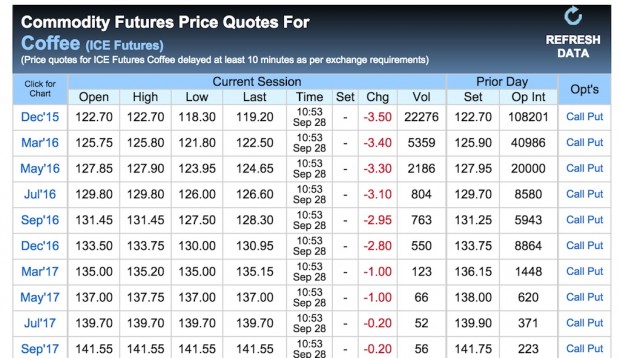

The latest ICE futures prices for coffee as of this publication.

A few days ago, I wrote about the need for producers to manage their exposure to price. Let’s start with a disclosure: I have no formal financial training. However, in my work with the coffee sector, I recognize that my focus has been on mitigating the risks — climate changes, diseases — on the production side. All of this work could be rendered useless if a farmer/cooperative does not also manage their risk to price and the market.

As I started to learn about price risk management, I recognized that there are lots of folks who have been working on this topic and who are trying to provide cooperatives and farmers tools to be able to deal with market volatility. My goal was to start a discussion with various points of view — with traders, producers, cooperatives, NGOs and certifiers — with the goal of trying to demystify this topic. The first interview is with Ed Canty, former lead coffee buyer at Keurig Green Mountain, who is currently running his own consulting business. Ed was the Fair Trade coffee buyer at KGM when he got serious about finding ways to incorporate price risk management (PRM) strategies for the coops he bought from. The following is a condensed and paraphrased conversation from our last few phone calls.

KK: I’m coming around to your point of view — that price risk management is an issue for the entire industry and not just for producer organizations. You told me that all public financing that has been invested in coffee producer organizations gets put at risk if the organizations don’t have a PRM strategy in place. This risk is then borne by the PO, but has effects throughout the supply chain.

EC: All lenders, NGOs, certifiers, importers, and roasters who consider their relationship with producer organizations as an investment have an interest in PRM strategies. The commodity market has become increasingly volatile in recent years. Without PRM strategies, organizations risk liquidity issues barring them from completing their commitments; or worse, threatening their entire business. This risk extends to their partners.

Financiers bear some of the greatest risk in collecting the pre-harvest financing lent to producer groups. Importers and roasters bear opportunity costs of needing to find replacement coffee and could incur the burden of re-applying financial futures and options to other physical product. NGOs and certifiers can see an erosion of their programs as producer organizations struggle in a volatile market.

However, all these stakeholders also need to consider the investment they have made in these organizations over the years. What is the true cost in losing those relationships? Do you understand what will happen to you partners if the market went to a lower or higher price? Is it worth protecting this investment by supporting producer groups in PRM training and assistance?

KK: You mentioned that PRM tools aren’t just limited to use of options, but rather there are more simple strategies that might be more appropriate for different producer groups, depending on their financial sophistication. Could you elaborate on this comment?

EC: Let me back into this. Using derivative financial products like options is a great tool. However, before contemplating using them, an organization needs to understand where their financial risk is. Understanding financial risk requires mapping out how your commodity-based contracts perform in different market scenarios — “what happens to my contracts in a dollar coffee market as compared to a $3 coffee market.” Those commodity-based contracts need to be negotiated with an understanding of the real cost of collecting and processing coffee.

If any of these previous steps are not done, using financial tools could be creating more risk than they solve for. So part of every organization’s PRM strategy is to review and set policy around the contract base they are managing. In review of their PRM strategy, many organizations may decide this preliminary work is enough at this time. Which can be an excellent decision. Jumping into advanced risk management tools too soon is risky.

Let me give you some examples:

I know of producer organizations whose policy is to commit to a market price on their contract only after 2/3rds of the coffee to fulfill that contract has been collected. Another organization only commits to a market price on their contract after having a full container in their inventory. The important thing is that organizations have a policy, which prevents the natural inclination to speculate against the market.

Organizations should have an on-going analysis of their costs of production for the quality their customers are asking for and bring this data into their negotiations. Even for cooperatives, who rely on the minimum explained in the Fair Trade standard, this is a step skipped by many organizations. Cost of production research is specific to each organization and an important first step in managing risk.

KK: Given that the cost of production is close to the price of coffee for many farmers for this harvest, why is PRM especially important in this low price market?

EC: I’m going to stick my neck out and expand my answer beyond what you are asking for here. No organization should negotiate a contract that would ultimately pay them below their cost of production. The majority of my experiences with PRM strategies are with Fair Trade Cooperatives, which have a price floor in their standards. However, what about other organizations or the contracts Fair Trade Cooperatives cannot sell as Fair Trade? How can these organizations manage risk if they are negotiating contracts that could go below their cost of production?

This issue is much bigger than the scope of this interview. We could talk about the power dynamic of producer organizations not comfortable with bringing cost of production data into their negotiations for fear the buyer will choose to shop elsewhere. We could talk about buyer’s behavior to always take the lowest priced coffee without considering external factors like investment in relationship, resiliency, or even feasibility of deliver into consideration. We could even discuss the difficulties organizations have in determining accurate costs of production.

However, for those of us who worked through the coffee crisis at the turn of this century, we know the mindset of a buyer changes in a depressed market. The dynamic for buyers changes from creating cost efficiencies to protecting against defaults on their contracts because the prices are so low. So why don’t we as an industry proactively address this issue now? Signing a contract without a minimum price that is specific to that organizations cost of production is risky and bad for everyone’s business.

If you can accept what I have written above, financial products become useful tools in maintaining minimum price and taking advantage of market opportunities. The time to discuss these tools is when the contract negotiation happens, not after the market changes significantly. They become increasingly less expensive the further away the market is from the cost of production value. The nuances of using these financial tools are much more complicated than can be written about in a paragraph. However the point I’m making is these tools become increasingly useful once both sides of the negotiation accept that maintain a minimum price is in both their best interests.

KK: In one of our earlier conversations, you mentioned that the strategies for estates are going to be different than those for PO.Why is that?

EC: Yes, the market realities of working with Independent Small Holders (ISHs) are different from working with Estates. ISH organizations always need to pay producers a local expression of the current commodity price to collect coffee. If they do not, producers will sell to someone else. Estates pay workers a rate that is not immediately tied to the commodity price of coffee. So their risk of not being able to collect coffee in a rising coffee market is greatly reduced. This allows many Estates to sign fixed price contracts without protecting against the risk of a rising market. I have less experience working with Estates on managing PRM strategies. However, this example highlights that understanding the differences in how organizations collect and pay for coffee is an important first step before including PRM strategies in a contract negotiation.

KK: Let’s talk about the most sophisticated approach to PRM: the use of options. The examples I have seen of it working really require close participation of the buyer/importer. Can you sketch out how these might work?

EC: Options are financial products that act as insurance policies against volatility in the market. A ‘Call Option’ allows for participation in a market above a specified strike price. A ‘Put Option’ allows for participants to secure a specific floor price if the market falls below that price. The costs of these tools are completely upfront, without any additional financial demand on the buyer of the financial product. They have the “option” to use them.

Options are great tools to bring into a contract negotiation as solutions to market volatility, while allowing each party to manage their own price discovery. I’m a little hesitant to give you a detailed example. The risk in managing these tools is in the details. A few paragraphs of text on how to use options is not an adequate for understanding to start using them. However, in the spirit of bringing some clarity to the opportunity of using these tools, I’ll provide two examples.

Using Options in a Low Market

As I write this, today’s March 16 C price is $1.20 USD. A producer organization is negotiating a contract for March and has analyzed that when the market falls below $1.40 they begin to go below their cost of production. So they want to sign a fixed price contract at $1.40 — this does not include the differential paid for the coffee. However, if they sign a fixed price contract and the market rises above $1.40, they begin to lose value, as producers they collect from need to be paid current market price. So they investigate the cost of a ‘Call Option’ to protect against this upside risk. The cost of a ‘Call Option’ for March 16 at a $1.40 strike price would cost 4 cents/lb. So they would ask for an additional 4 cents in their differential negotiations to manage this risk.

Using Options in a High Market

Let’s pretend the market for March was at $2.00 USD today. This same producer organization is negotiating a contract using a break-even cost of production market value of 1.40, not including differential. They want to protect against the market going below their floor price, yet still maintain the opportunity of an upside market at any given time between now and shipment. They investigate the cost of a ‘Put Option’ for March 16 and determine, in this fictitious example, that it will cost 2 cents/lb. So they would ask for an additional 2 cents in their differential to manage the market going below their cost of production floor.

In both these examples it is important for the buyer and seller to understand the analysis and upfront cost of a PRM strategy. As with all costs, the buyer ultimately pays for them. The seller could bury this information in their differential cost. However, this might make the producer organization less competitive than other groups who are taking risks in their negotiations. A producer organization wants to highlight the value created by a solid PRM strategy. Their proposed price structure creates more assurance in meeting the terms of the contract and being a resilient supply partner in the future. A buyer who expects any less in a contract negotiation is taking advantage of the situation.

These tools are not new to this industry. However, they are not commonly used by producer organizations. In fact, the same tools can manage risk between any transactional relationship. For example, importers commonly use them to manage the risk between themselves and a roaster. One of the most innovative uses of options I have seen are programs that manage the risk between farm-gate collection (seller) and producer organization (buyer). We have seen marketing volatility that almost reached 10 cents in a day this last year. This can have a devastating effect on producer organizations’ abilities to collect coffee and manage risk. This is one of the most advanced uses of PRM strategies that I have seen.

KK: WOW, we have covered a lot of ground. Anything else to add?

EC: In conclusion, I’d add that using PRM strategies is the exact opposition of speculating in the market. People tend to confuse these two things when we discuss using financial tools. These same tools are used to speculate when they are not tied to a physical product. What we have talked about today is more firmly embedding them in the negotiation and physical trade of coffee. This means any gain from using the tool offsets loses in the market, by design. So there are no windfalls created by using them — rather, just healthy insurance against the risks present in coffee trading.

Second, I’d like to reiterate that managing risk is inherently risky if you jump into it without a practical knowledge of how to use advanced tools. Start by understanding your risks and enter into contract negotiations with the mindset that bearing that risk is unacceptable and bad business for all involved.

Kraig Kraft

Kraig Kraft is the CRS Technical Advisor for Coffee and Cacao for the Latin America/Caribbean. He is Based in Managua.

Comment