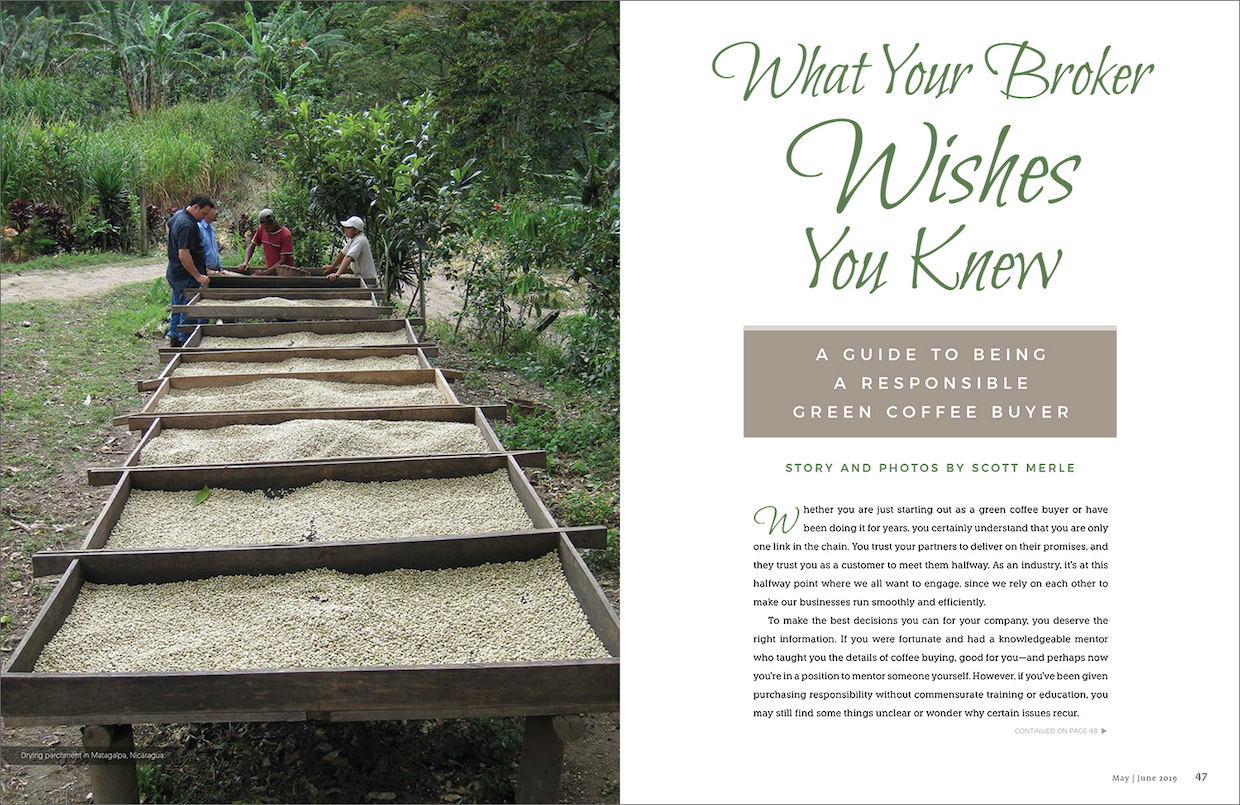

(Editor’s note: This article written by Scott Merle originally appeared in the May/June 2019 issue of Roast magazine. Photos by Scott Merle.)

Whether you are just starting out as a green coffee buyer or have been doing it for years, you certainly understand that you are only one link in the chain. You trust your partners to deliver on their promises, and they trust you as a customer to meet them halfway. As an industry, it’s at this halfway point where we all want to engage, since we rely on each other to make our businesses run smoothly and efficiently.

To make the best decisions you can for your company, you deserve the right information. If you were fortunate and had a knowledgeable mentor who taught you the details of coffee buying, good for you — and perhaps now you’re in a position to mentor someone yourself. However, if you’ve been given purchasing responsibility without commensurate training or education, you may still find some things unclear or wonder why certain issues recur.

You likely already have a small group of brokers you work with. Expanding this group and refining the communication with your partners can increase your knowledge and improve your chance of success. From our side as brokers, cultivating strong relationships with our clients is a cornerstone of the trade. Our goal is to provide the best coffees and services your company requires, since your success is our success. Reaching this goal requires trust, collaboration, and a shared understanding from both sides to succeed in finding that happy middle ground.

For this article, I reached out to a group of fellow brokers (a general term referring to importers or traders) — whose collective experience spans decades and covers every corner of the coffee value chain — to share their insights on items that are often overlooked or misunderstood. Due to the frank comments that emerged from my conversations, direct quotations have not been attributed. The list of interviewees can be found at the end of this article.

This honest advice is being provided with the understanding that the hard work of meeting halfway is a responsibility we bear equally.

It All Starts With Communication

In many ways, every point in this article can be solved with ongoing and effective communication. It is crucial that we communicate well to get the most out of these partnerships.

“We taste hundreds of coffees a day — many of which may be a perfect fit for your needs — but if we don’t know enough about your business, understand products you are hoping to launch, or coffees you would love to have, then we aren’t able to alert you to coffees that may work well for you. Do you ever wonder why your competitor seems to get their hands on such great/interesting coffees? It may be that they have a very close working relationship with their broker, and they are being turned on to great coffees before they become available on a spot offer sheet.”

Start by finding a broker you enjoy interacting with and then communicate regularly about what types of coffees you want, and what type of business you are after — grocery, retail, or price-sensitive accounts — to help them determine what price points you need. A broker can deliver extraordinary value when they have a clearer picture of what you are seeking.

“Use clear language when communicating. ‘Yes,’ ‘Confirmed,’ ‘Approved,’ ‘Rejected’ are all examples of clear language. ‘I guess’ and ‘Sounds good’ are not as clear, but we may need to take those as affirmative answers.”

Minimizing uncertainty in your responses is important, as a broker may move forward with executing contracts, issuing fixations and releases, or determining terms based on your answer. Ambiguous responses may be taken as confirmation by the trader; allowing room for interpretation can be risky business for both parties.

“You may get an offer that doesn’t work for you because of price, holding period, or quality. Instead of rejecting it outright, tell your broker why it doesn’t work.”

By communicating the issue in a clear and direct way, your broker may be able to make adjustments to the current offer, or at least learn how to make a better offer next time. Clarity, as well as timely communication, are key to a successful and productive partnership with your broker. Coffees may come and go quickly, so your ability to make a swift decision can also be a great advantage.

“Coffee is your most expensive asset; it’s what your business is made from. Importers should be someone you are very close to because we are the carriers and holders of your most valuable asset.”

We’ll do our best to cover every aspect of a transaction and ask for clarity if anything seems undecided, but we can’t know if you’ve always done something a certain way unless you tell us. Outlining all the conditions you need every time, even if it seems redundant, is helpful.

“Don’t give a producer the impression you will commit to a coffee if you are uncertain or know you won’t take it.”

When evaluating coffee at origin, creating an unrealistic expectation is deceitful and can be costly to both parties. Producers deserve every chance to market their coffees until they sell, so be clear and direct with your intentions.

Come Prepared

Coffee is a friendly business, and handshake deals are common, but there are frameworks that guide various aspects of the business. Buyers should be familiar with the documents and terms used widely across the industry.

“Coffee buyers should understand the Green Coffee Contract, developed by the Green Coffee Association (GCA), as it is the basis of the coffee transaction. No, you can’t reject an SAS/NANS contract because you aren’t ‘feeling it’ or be upset that your importer applies carry charges to coffee that you did not pick up past the contract period. These aren’t made-up rules to punish or trick you; they are standard parts of any green coffee transaction.”

The Green Coffee Contract was last amended in November 2018 and can be found on the Green Coffee Association website.

“Understand delivery and payment terms. Those are integral components we use to calculate accurate pricing.”

If you request a change to previously agreed-upon conditions, understand that there may be extra costs involved, and be prepared for that discussion.

“Know your position. If you’re behind, don’t make importers chase you down for it.”

It is important to take your coffees according to the contract — or let us know read them on receipt, and either remark on any errors or sign and return them to us promptly.

On Coffee Quality and Evaluation

The many improvements we have made to measuring and defining coffee quality are narrowing the differences and reducing misunderstandings among partners. While we may not have found 100 percent agreement on the subjective parts of coffee, communicating expectations and results is easier than ever.

“Understand why you can reject a coffee, and when you should not.”

Generally, for a contracted pre-shipment or arrival sample, an approval should be issued if the coffee meets the defined grade specifications and is sound and free of defects and taints in the cup. Any other reason for a rejection must be worked out with your broker.

“Provide enough clarity in terms of profile. In some ways, scoring coffees has made it easier to communicate quality, but it has also oversimplified what is intrinsically a matter of preference. Not all coffees with a score of 84 taste the same, and I come across disappointment or even outright rejection because ‘it lacks stone fruit’ or ‘is too bright for my intended use.”

If your perception of a specific flavor is the deal breaker, let us know beforehand and we can work more directly toward the solution.

“Sometimes folks can try too hard to show they know coffee, leading to distractions and lack of focus [at the cupping table]. Also, there can be a tendency to be too hard on coffees to show ‘I’m all about quality and none of these impress me.”

Dismissing a coffee can feel like the safe answer, while verbalizing positive attributes in a coffee that may be unexciting but otherwise sound can seem risky. However, identifying a sample’s positive traits can also show flexibility and be a healthy exercise for expanding cupping skills.

“Don’t buy off the table at origin. Always request the broker to send samples to your own lab.”

Your final decision will likely be made based on a sample roasted and cupped in your own facility. If there is a chance you won’t like it there, we’re all better off not reneging on a promise later.

On Paying Your Bills

Responding to offers and samples promptly will benefit your working relationship with your broker, but taking releases and paying your invoices on time will strengthen it even more.

“Many times, green coffee prices are quoted based on your behavior as a buyer. If you always pay net-60 or net-90 when you actually have net-30 terms, your coffee prices may be higher to cover the fact that you don’t pay on time. Gone are the days when rising-star roasters used importers as a bank for zero-percent-interest short-term loans.”

Financial planning and the prudent use of cash have become more important in the coffee trade than ever. Brokers have been forced to catch up with the times and manage their pricing and receivables like their business depends on it, because it does. Don’t be surprised if you are contacted right away for any overdue balance.

“How you pay directly correlates to the price you receive.”

Not only do we have to calculate regular carry costs to holding coffee, but a customer’s payment tendencies will be considered and affect this final pricing as well.

“Importers are the guarantors of paying producers in a timely fashion, and most reputable importers do so without a glitch. If roasters don’t pay on time, or at all, it’s essentially putting the importers’ ability to pay growers at risk.”

It is crucial to keep the money flowing downstream. An importing company won’t stay in business or have access to top coffees for very long if it earns a reputation for delayed payments to origin. Your timely payments help us stay timely as well.

On Keeping Your Word

Asking a broker to take contracted coffee back is not ideal, but it persists as a recurring problem. With proper planning, these risks can be mitigated.

“Book/future only what you know you’ll roast.”

“You have to take the coffee you buy. Your integrity and your company’s reputation could be damaged by not following through. As a buyer you have to make sure this process is properly managed.”

Carrying or booking extended inventory is dangerous to your bottom line and can spell increasing trouble as you push coffee deliveries further out. Any request to back out of contracted coffee should be considered only as a last resort.

“One contract is not dependent on another.”

Considering there is another contract behind the one you wrote with us, it is unlikely that a respected broker will risk irreparable damage to its reputation by breaking the contract with its partners at origin.

On Complexities at Origin

For direct-trade deals, particularly with microlots, asking a producer to segregate higher quality from the rest creates inferior grades, which must be sold at a lower average price. Even if the higher quality fetches a higher price, a conscientious buyer who is a good partner should understand these tradeoffs.

“Focus your efforts around buying everything the producer can produce instead of skimming off the top best of the best and leaving them to sell the rest at a much lower price. They need a fair price on all of it.”

Exploring the option to buy different lots of coffee from the same producer may reveal benefits including possible cost savings, better access to volumes in the future, and the strengthening of your relationship.

“Everything gets milled, and yield is important. Five or 50 bags of parchment does not equal five or 50 export bags. Some percent of that coffee gets milled out and will be sold at a lower price or blended somewhere else. This is one component of your FOB cost.”

Every step has a cost, and it is normal for the price-per-pound to increase as the lot size shrinks. More thorough familiarity with milling processes and the associated volume reductions will prepare you for any resulting FOB price changes from what you expected based on farm-gate price.

“If you do direct trade, you assume the risk of quality upon arrival.”

This absolutely depends on your broker for each individual deal, but everyone must understand who owns the risk from the start. Advance communication and agreement on this point is critical.

“If you are negotiating your own prices, ask more people for pricing before you commit to a price FOB to make sure you aren’t way out of the market.”

There may be unintended consequences to the producer by creating unrealistic market value, should you drop the relationship or wish to renegotiate in the future.

“Differentials are intrinsically a complex issue, since there is no open and verifiable market for them (like the “C”). We rely on what others are offering their coffees at to validate (or not) the differential expectations. They are greatly influenced by local supply-demand dynamics, currency valuations and the particular demand for any given origin on any given time. In my experience, differentials are easier and more accurately found for more generic coffees, but less for specialty-grade coffees with a story.”

Differentials are neither static nor imaginary. They can be both complex and complicated, and may change rapidly as conditions change. It is normal for differentials to adjust regularly, not only from year to year, but week to week and day to day, and not simply in opposition to the “C.”

The Last Word

Most people in coffee are true professionals and tend to stick around even as we change jobs, responsibilities, companies and loyalties. The relationships we build and nurture during our careers may adapt over time, but they can remain valuable connections throughout.

“One of the great parts of being in coffee is the character of people. There are intrinsic values in being a high-character person. What makes a good green coffee person? Someone who values functional trust and works with humility and good intention to build it.”

“Coffee is a small industry. People circle around a lot between companies and you never know when someone is going to be the next buyer, seller, roaster or owner. We all are in this because we love coffee—being a good person and a responsible buyer go a long way.”

Working “with humility and good intention” and being a “responsible buyer” are excellent foundational elements from which to build the rest of our reputations. We all exist together in this special industry, and it’s been my experience that living by the Golden Rule pays exceptional dividends.

Special thanks to these knowledgeable and experienced individuals for their contributions to this article:

Dana Andrews—Trader, Q Grader, InterAmerican Coffee

Tim Chapdelaine—VP Sales/Director of Americas, Trabocca BV

Jorge Cuevas—Chief Coffee Officer, Sustainable Harvest

Katie Gilmer Pon—Green Coffee Sourcing and Sales, La Minita Coffee

Mark Inman—Director, Director of Growth, Sustainable Harvest

Alex Mason—Trader, Royal Coffee

Kayd Whalen—Senior Vice President, InterAmerican Coffee

Scott Merle is the senior vice president of La Minita Coffee. He is a specialty coffee veteran with experience in every aspect of the coffee value chain, including green coffee sourcing, purchasing, roasting and sales, and is proficient in various types of coffee evaluation. Scott has a long and rich history of volunteering within the industry and has dedicated himself to pursuing excellence in coffee quality on all levels, from origin through roasting.

Comment