In Part 1 of this story, we outlined the ways in which coffee is typically procured, while contrasting that with the way it is marketed by coffee brands.

In this Part 2, we’ll explore in much more detail how co-branding that takes into account the value and interests of both coffee producers and coffee roasters can potentially provide more positive economic benefits to all parties involved, while adapting to growing consumer demand for more knowledge and understanding about the specific ingredients they consume — in this case, single-origin coffee.

Farmers and Origins Seen as Co-Brands

A few decades ago, David Aaker, a notable brand strategy specialist, supported the notion that co-branding was “a powerful tool to provide fast, effective response to a relevance problem.” During the 1980s and 90s, co-branding was also seen as a strategy to create a point of differentiation. In Aaker’s words, using someone else’s brand in a branded product — for example, the Intel inside® mark in a branded computer — “augments and enhances the branded offering because it is relevant, provides credibility of claims and can communicate benefits.”

Many brands from a variety of industries have agreed to coexist in single products. The conditions to develop these relationships often depend on a technical and differentiation fit. The technical fit refers to traditional procurement aspects, such as quality or delivery capabilities, whereas the differentiation fit relates to the ability to create additional possibilities for differentiation and innovation by working together.

However, even when these two conditions exist, oftentimes the co-branding relationship may be short-lived if the values and philosophy fit between the two organizations is absent. Successful differentiation and relationships mostly depend on the ability to reflect those values in the co-branded final product, leading to long-lasting co-branding partnerships, a relationship that brings the two parties together based on shared values and beliefs.

The relational value chain responds to the modern-day needs of brands with deeper product and ingredient knowledge, labeling transparency, continuous innovation and reputation-related risk management. Ingredients are much more important now than they have been in the past, and they often present a value promise in themselves. Modern consumers are increasingly interested in knowing exactly what they are consuming, how it was made and processed, and who made it.

The success of higher end grocery stores, farmers markets — according to the USDA, there are nearly 9,000 farmer markets in the United States compared to just over 5,000 Walmarts — artisanal beer, and direct trade hubs also suggest that consumers favor products that can demonstrate genuine content rather than the implicit detachment to farmer and individual origin realities associated with VSS certifications.

Many of the most successful third- and second-wave coffees are effectively portraying origins and farmers as a form of co-branding, creating narratives about both the origin (producers) and the roaster brand that are relevant and appealing. Single-origin coffees are not in these cases mere ingredients. The challenge is to bring those benefits to a larger population of farmers to create relational models that can bring additional value and a better distribution of the value created.

Origin Co-Branding Coffee Benefits

As big brands struggle to remain relevant to consumers that favor artisanal and human stories, they have to evolve with “authentic producing-world content.” They have an opportunity to associate with origins that can provide a sustainability commitment that reflects both local priorities and consumer demands, a reliable supply and the ability to continuously generate content and narratives that reflect the brand values and promises. In other words, looking at origin as co-brands would lead to a relational governance framework that can attract large farmer groups and associations looking for long-term partners that would help them reduce coffee price volatility, access crop insurance mechanisms, and mitigate and adapt to climate change.

The continuous development of single-origin marketing can offer significant differentiation possibilities to coffee brands. Apart from providing the content and brand relevance that modern consumers desire, origins have the ability to leverage the three key pillars that differentiate successful coffee brands: transparency, quality and knowledge.

Successful origin co-branding partnerships create opportunities to unlock value through emotional, rational, sustainability and experiential differentiation, the holy grail of a 4.0 brand. Consequently, when marketing single-origins, first-, second-, or third-wave coffee brands should seriously consider not only the intrinsic qualities of the coffee origins they sell, but also the authentic origin narratives that best fit their own brand’s heritage and organizational values.

Gone are the days when origins were described in labels as “ideal” places to grow coffee in the midst of lush vegetation and pristine water. Modern consumers increasingly demand access to credible information that explains the human perspective of the individual grower or the community of growers at coffee origin, solid knowledge that supports the relationship between high quality and origin, as well as the social and economic effect that coffee brings to the area.

As coffee brands seek to demonstrate to consumers the depth of their knowledge regarding the coffees they sell, they will also need to be able to better communicate to their clients the stories behind those coffees, and the complexity and dedication of producing high-quality beans.

The success of the co-branding model also requires that farmers themselves begin to look at their origin — their own farm, community, region, or country — as a brand. They should be conscious that they are not merely selling a product, but a package of services that includes authentic, consistent narratives that will support the commercial success of their beans. They should develop their own brand purpose and be prepared to deliver the consistency in quality and service that their buyers require in order to build long-term relationships. They should be prepared to deliver on farmer-led sustainability efforts and indicators, and to participate in annual progress reviews measuring aspects of their product-content packages.

However, maintaining brand alliances, as co-branding demands, can be difficult. Aaker and other brand theorists recognized that aligning the long-term interests of different consumer-oriented brands is complex. This is why successful farmers and their organizations should also consider segmenting and protecting their origins — using intellectual property tools such as origin certification marks, trademarks or Geographical Indications — to maintain control of their products’ reputation and to be able to create longer-term commitments based on the value of specific criteria to key customer brands for different geographies and distribution outlets. Clearly, farmers, community or regional coops should not be limited to a single buyer for their coffees, but should be in a position to provide more value on a consistent basis to those clients willing to pay more for their coffees and services.

Farmers and Their Organizations Also Need to Evolve

Most of the producer world has voiced their complaints on the unequal value distribution present in the coffee category. Farmers, of course, are facing significant economic difficulties, market access challenges, high transaction costs, income volatility and climate variability, putting them at significant economic risk. The market, commonly defined as the C contract, appears to be failing to provide long term incentives for quality coffee production, leaving many producer organizations to call for minimum prices.

Against these difficulties, many producers are considering roasting their own coffee at origin and developing the means to access consumers directly, via platforms or alternative distribution models, as a way to increase economic benefits. Others focus on tourism as a way to achieve an economic upgrade. While there are success stories that can substantiate these alternatives as viable avenues of growth, it is doubtful that the vast majority of the millions of coffee farmers of the world would be able to successfully implement these strategies.

A larger, but still relatively small portion of farmers is already benefiting from the relational governance model, developing mutually dependent relationship with their clients. Creating the conditions to scale up this model so that these relationships can reach more farmers and more market segments will not only require that coffee brands accept and seek out single origins as potential co-brands, but that producers and their organizations develop origin equity and pursue branding from below strategies that help differentiate and achieve higher price points for their co-brand partners.

Clearly, producers and their organizations are lacking a comprehensive agenda that can really alter the current coffee industry value and income distribution model. This is why it is so important that they review the co-branding model as an option to develop an origin equity, or “branded origin strategies,” that will elicit partnership opportunities at the farm, community, region, or country level.

Farmers and their organizations will need to consider developing their own sustainability strategies, being catalysts for product innovation, developing and enforcing origin quality specifications, and focusing on their own product knowledge. Much like the citizen science approach, the means to enhance product knowledge and the relationship between environment and quality can now be achieved based on science. The proposed relational model can also become the basis for reducing farmer risks with new forms of price hedging and crop insurance based on the data obtained by this “farmer science” approach.

In order for origins to become brands, they will need to consider their intellectual property options, such as Geographical Indications, Collective or Certification Marks, authentic stories of origin, and their own ability to segment and negotiate with buyers. Buyers, on the other hand, will need to respect the value of origin intangibles, just as they do with their own brands. Clearly, origin stories belong to origin, and as an intangible asset, they should be leveraged by both coffee brands and farmers for their authenticity and not be undermined by stereotypes.

The success of the co-branding model depends on the efforts of both origins and brands. Most farmers do not currently see buyers as potential partners and continue to exhibit an opportunistic behavior, willing to sell to the highest bidder when various portions of their harvest become available, in many cases defaulting on previous sale commitments. Similarly, many buyers are willing to change “sources” when they can achieve a similar flavor profile at a lower cost. Origin co-branding, with the final objective of delivering origin equity to consumers, will ultimately require the change of these one-sided behaviors.

A Possible Road Ahead

As both roaster brands and origins begin to engage in this co-branding concept, new forms of transacting coffee and the intangible services implied will emerge. Transaction prices will become more complex, based on the mutual commitment to perform in multiple areas of quality, content, and sustainability, reinforcing the relational nature of the business.

At the Let’s Talk Coffee conference sponsored by Sustainable Harvest last year in Cartagena James Hoffmann’s presentation suggested that contracts, currently defined by the old commodity transactional frameworks, will also need to evolve. In the co-branding approach, contractual arrangements will focus on more than just quality and delivery. Supplier performance indicators will also become more complex as the relationships evolve. Importers and traders will need to improve, acquire, or collaborate with specialists offering relevant capabilities. Their function will not be limited to product brokerage. They will need to offer coffee brands differentiated origin narratives that align with their own values and purpose.

Thus, marketers and storytellers will become part of the co-branding relationship, traveling frequently to origins, understanding and communicating their challenges to customers, particularly younger consumers aware that coffee origins are increasingly under stress and that basic sustainability is an ever present and varying challenge and not just a certification.

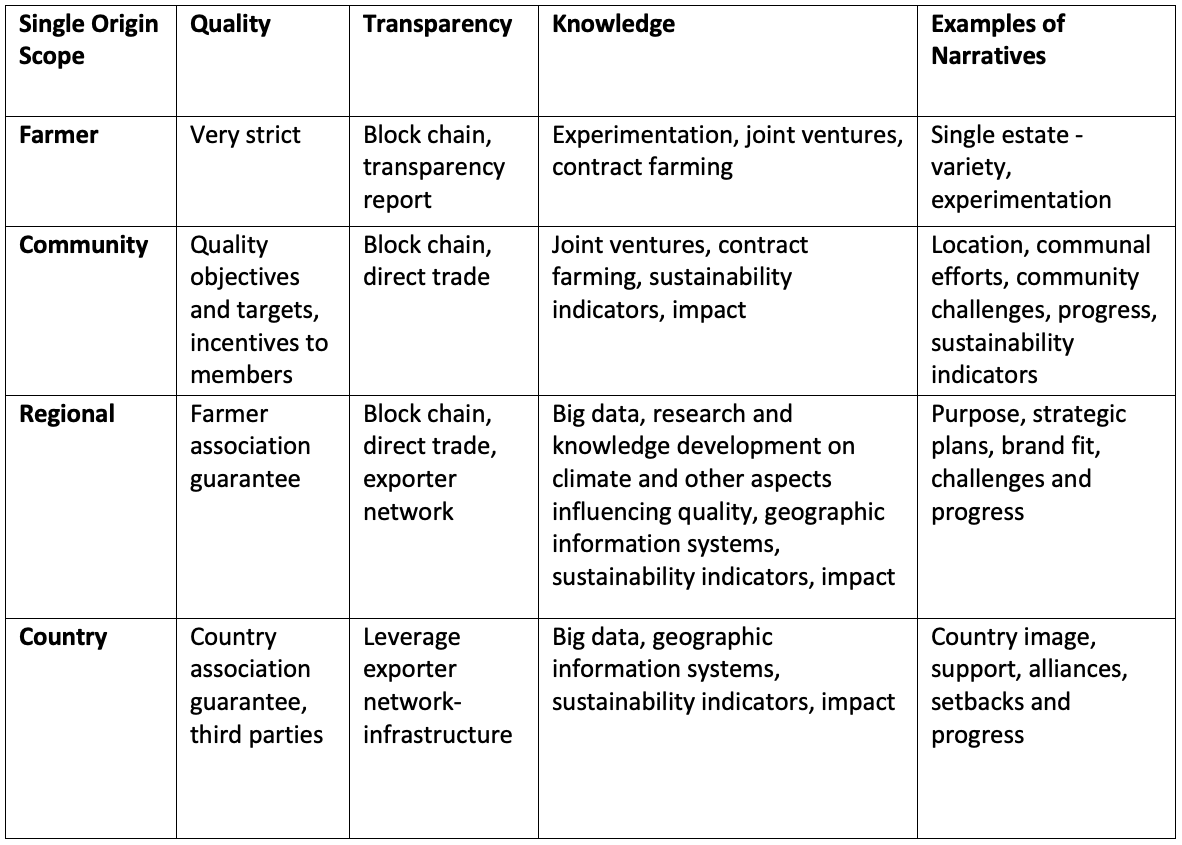

The opportunity for segmentation of origin co-branding adds another level of flexibility and an opportunity to impact a larger farmer population, as it can adapt to different market segments and price points. Origins will now compete not just on price but also on a number of attributes, achieving different price points depending on the additional value they provide. An example of this market segmentation that leads to the relational model is summarized in the following table.

By adopting this continuous improvement model using the processes and layers defined here, we can create, as an industry, the basis for positive competition and still maintain market-based mechanisms as a way of generating more value and additional dynamism in the coffee industry.

Once again, coffee would be in a position to show the path to other tropical products. At this time of pricing volatility and economic uncertainty in coffee production, these types of new and proactive steps that take into account the interests of all value chain actors can provide an opportunity for industry members to bring the coffee industry where it needs to be for the benefit of the next generation of coffee growers and consumers.

Luis F. Samper and Jan Anderson

Luis F. Samper is the president 4.0 Brands, based in Colombia. Samper is a former CMO of the Colombian Coffee Growers Federation (FNC) and co-author of number of publications on coffee, including “Juan Valdez, The Strategy behind the brand,” “The powerful role of intangibles in the coffee value chain” and “Towards a Balanced Sustainability Vision for the Coffee Industry.” Jan Anderson is CEO of Premium Quality Consulting, LLC, and is a consultant with experience in marketing, market research, analysis, and brand strategy. PQC conducts primary research in their proprietary data base of coffee brands in order to analyze changes in consumer preferences and industry trends in North America.

Comment