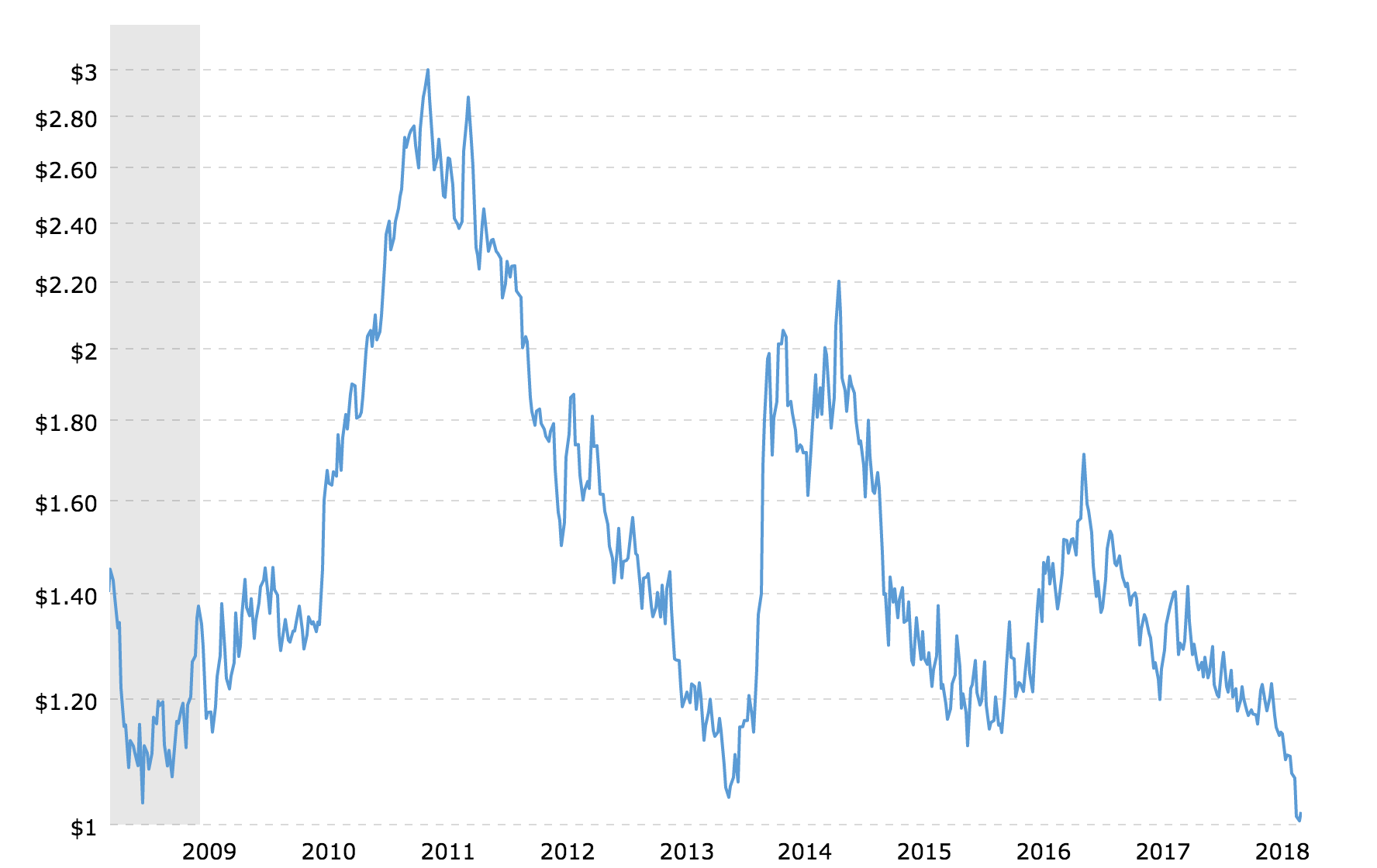

Coffee prices on the New York C market dipped below $1 per pound for the first time since 2006 last week.

Coffee sector leaders in Brazil and Colombia, the world’s two largest producers of Arabica coffee, used strong language yesterday in a joint statement regarding shared responsibility as coffee’s prices sit at historical lows on the commodities market.

The statement assigns culpability to a wide range of actors in and around the coffee trade with short but stinging critiques, while also underscoring the economic and existential threats that the current depressed prices pose to the global coffee sector and the millions of people who depend on it for their livelihood.

More than a week ago, the New York C price for coffee fell to below USD$1 per pound for the first time since 2006.

“Currently, international coffee prices are below production costs, jeopardizing the economic sustainability and survival of 25 million coffee families worldwide,” the joint statement contends.

Signed by 11 representatives from Colombia and Brazil representing the largest farmer support and agricultural agencies in both countries, the statement outlines factors that have resulted in a global coffee market that is fundamentally designed for people in producing countries to absorb the risks of price volatility.

The document takes aim at market speculators, who buy and sell in anticipation of market movements:

A major concern are the external factors that negatively affect the international prices and producers, such as the financial speculation of actors outside the chain, who, in a constant and perverse way pressure coffee prices, forcing migratory movements motivated by poverty and the expansion of illicit crops in some countries.

It takes aim at parties holding green coffee stockpiles outside of producing countries:

The holders of coffee stocks have a greater influence on the formation of international prices. Therefore, it is fundamental to equate the current imbalance, shifting the stocks from consuming countries to producing countries.

It takes aim at opportunistic traders in consuming countries:

The major concern of all producing countries is the concentration of the industry and the distribution sector, which impose on producers, for example, abusive payment terms of more than 200 days, which massacre any possibility of economic sustainability for producers.

It takes aim at large traders and roasters in consuming countries who may be paying lip service to sustainability in the coffee sector without backing that up through sustainable business practices:

The programs that some multinational companies do to promote sustainability are offset by their business practices.

Finally, it takes aim at a group of people around the coffee sector who are typically viewed — at least in consumer countries — as advocates of producers and more sustainable markets, or as well-intentioned intermediaries between actors on the supply side and actors on the demand side:

Likewise, international non-profit organizations that promote coffee cultivation must take responsibility for absorbing the resulting production surpluses.

DCN will have more on coffee’s current price crisis in the coming days — particularly on how and why it relates to the specialty coffee market. For now, here is the joint statement from the Brazilian and Colombian coffee leaders in full (signatories listed at the bottom):

Representatives of coffee production in Brazil and Colombia met today at the Brazilian Ministry of Agriculture, Livestock, and Supply (MAPA) in Brasília to discuss the world coffee prices crisis and the economic imbalance within the production chain, which impoverishes producers, and the actions to be taken to confront this scenario.

Currently, international coffee prices are below production costs, jeopardizing the economic sustainability and survival of 25 million coffee families worldwide.

A major concern are the external factors that negatively affect the international prices and producers, such as the financial speculation of actors outside the chain, who, in a constant and perverse way pressure coffee prices, forcing migratory movements motivated by poverty and the expansion of illicit crops in some countries.

The holders of coffee stocks have a greater influence on the formation of international prices. Therefore, it is fundamental to equate the current imbalance, shifting the stocks from consuming countries to producing countries. It is necessary that the producers develop internal policies to support the ordering of the supply, as is the case of Funcafé in Brazil, that finances the carry of inventories to avoid sales in moments of depressed prices.

It is also important that the stock formation in producer countries be managed by the private sector coherently with market risk management tools.

Another crucial point is the importance of increasing consumption in emerging markets and producing countries, for which the support of the International Coffee Organization (ICO) is expected.

The major concern of all producing countries is the concentration of the industry and the distribution sector, which impose on producers, for example, abusive payment terms of more than 200 days, which massacre any possibility of economic sustainability for producers. The programs that some multinational companies do to promote sustainability are offset by their business practices. Likewise, international non-profit organizations that promote coffee cultivation must take responsibility for absorbing the resulting production surpluses.

Brazil, Colombia and the other producing countries, as expressed at the First World Coffee Producers Forum in Medellín, Colombia, on July 2017, will consider all necessary actions to solve the crisis that threatens the future supply of coffee and expect that all links in the productive chain act jointly and in a co-responsible manner given the grave situation. Coffee producing nations will meet again in September during the ICO meetings in London to deepen this discussion.

It is a priority for producers to communicate to consumers globally the current situation and how this market scenario creates a spiral of poverty in producing countries.

Signed by the representatives,

– Silas Brasileiro, Conselho Nacional do Café (CNC) – Brasil

– Silvio Farnese, Ministério da Agricultura, Pecuária e Abastecimento (Mapa) – Brasil

– Roberto Velez, Federación Nacional de Cafeteros (FNC) – Colombia

– Juan Esteban Orduz, Federación Nacional de Cafeteros (FNC) – Colombia

– Aguinaldo José Lima, Associação Brasileira da Indústria de Café Solúvel (Abics) – Brasil

– Vanusia Nogueira, Associação Brasileira de Cafés Especiais (BSCA) – Brasil

– Arnaldo Botrel Reis, Associação dos Sindicatos Rurais do Sul de Minas (Assul) – Brasil

– Carlos Paulino, Cooperativa Regional de Cafeicultores em Guaxupé (Cooxupé) – Brasil

– Lúcio Dias, Cooperativa Regional de Cafeicultores em Guaxupé (Cooxupé) – Brasil

– José Marcos Magalhães, Cooperativa dos Cafeicultores do Sul de Minas (Minasul) – Brasil

– Breno Mesquita, Confederação da Agricultura e Pecuária do Brasil (CNA) – Brasil

Nick Brown

Nick Brown is the editor of Daily Coffee News by Roast Magazine.

Comment

2 Comments

Comments are closed.

GOOD ARTICLE IT IS EXERCISING SOCIAL RESPONSIBILITY

“It takes aim at Brazil’s record 60.2 million bag harvest and the stocks that were held over in Colombia from last year:” Oh wait, they forgot that.