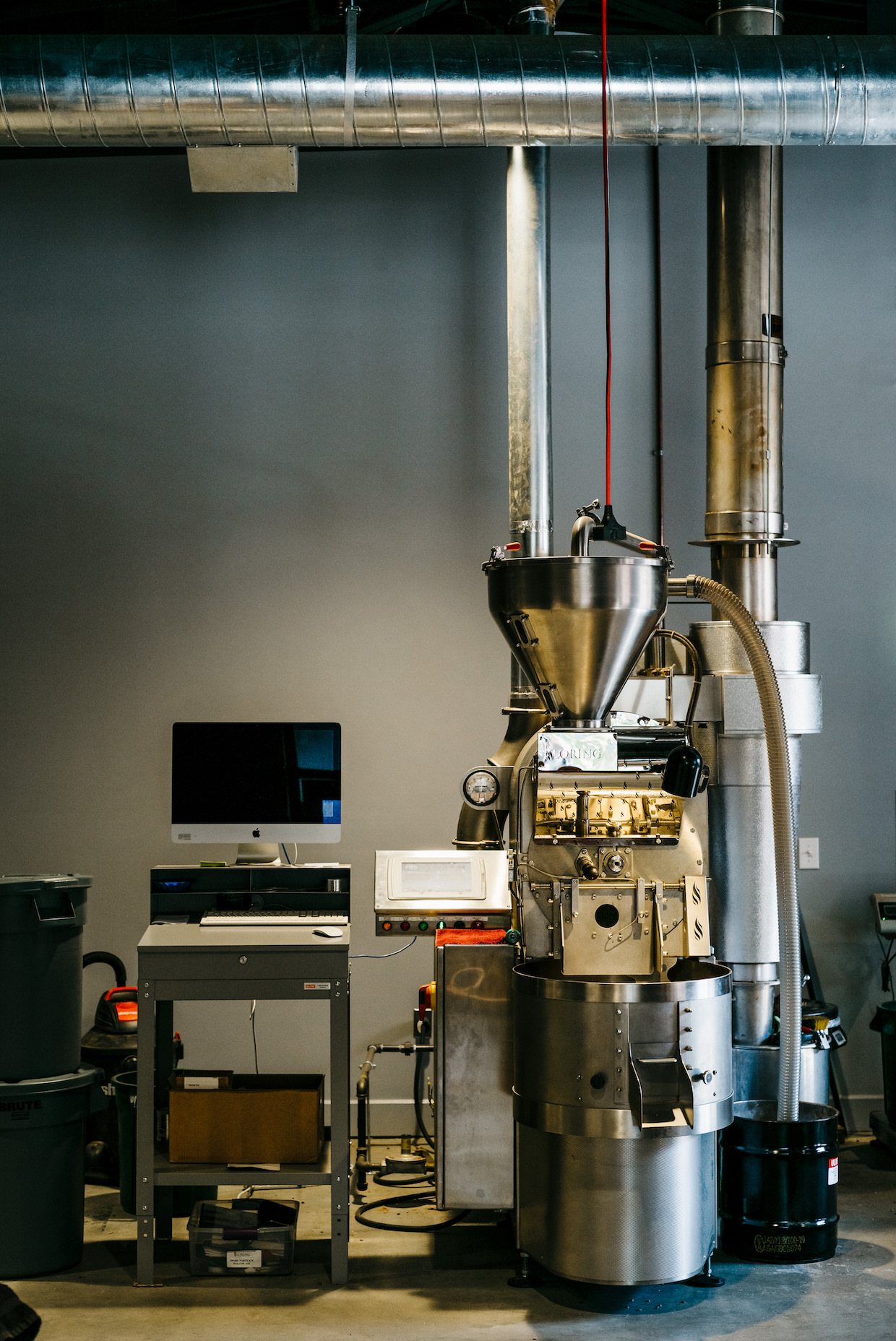

At the Passenger/Necessary Coffee production facility in Lancaster, Pennsylvania. All photos courtesy of Necessary Coffee.

Roasting companies that pursue only the absolute highest quality of coffees operate sourcing programs that are, by definition, exclusive. The farms that produce those coffees, on the other hand, are not.

Most coffee farms big and small end up with a range of coffees in any given growing season, and their highest-quality offerings may only represent a fraction of the total volume — yet every bit of that farm’s coffee still needs to be sold. When prices paid for run-of-the-mill green coffee dip below the costs of production, those sales go from a matter of profit and loss to a matter of survival.

Necessary Coffee is a roasted coffee brand that launched over the summer in recognition of this market-related conundrum. The brand is an offshoot of Lancaster, Pennsylvania-based Passenger Coffee, which is exactly the sort of quality-obsessed coffee company that tends to purchases of only the very highest scoring beans. Through the Necessary brand, the B Corp-certified roasting company can now buy far greater volumes of coffee from the same producers, offering them sustainable prices while forging longer-lasting partnerships in the process.

“There is no shortage of roasting companies in the specialty industry who are eager to pay high prices for rare, exotic coffees that routinely earn the highest quality scores on the cupping table,” Necessary and Passenger Director of Coffee Evan Howe told Daily Coffee News. “What is less commonly discussed is the fact that these unique coffees, coffees that we love and are proud to present on Passenger’s menu, often make up a very small percentage of a producer’s total harvest. So what happens to the large amount of ‘good’ coffee that remains after the small amounts of ‘great’ coffee have been snapped up? In many cases, these coffees are sold at or below the current market price for coffee, a price that reflects the supply and demand economics of the international commodities market rather than producers’ actual costs.”

Upon each bag of Necessary Coffee is the motto, “Strong Partners Make Rich Coffee.” Bags and other materials emphasize the importance of fair pricing and equitable trade with an enthusiasm equaled only by the descriptions of each product’s accessible flavors.The bags themselves feature a throwback design, that recalls 1950s grocery store chic.

Said Howe, “With the packaging we’re hoping to convey that, while we do see Necessary as an opportunity to pose important questions about coffee to a broader audience, we absolutely want the starting point of that conversation to be a coffee drinking experience that’s fun, approachable, and delicious.”

Passenger Co-Founder and CEO Kyle Sollenberger told Daily Coffee News that the beans sourced for Necessary score an average of 83-85 points, and come from the same farms that produce the higher-scoring coffees purchased by Passenger.

“We are not closed off to the idea of a relationship being unique to Necessary,” said Sollenberger. “It may not always make sense or be possible to source strictly from preexisting Passenger relationships.”

Roast profiles for Necessary skew darker than they do for Passenger coffees, and the retail prices are more accessible as well, averaging around $13 for 12 ounces of Necessary beans as opposed to the average $14-$18 per 10-ounce bag by Passenger. Necessary coffees are subjected to the same stringent production and quality assurance practices as Passenger’s.

“With the current market price for coffee hovering well below cost of production for the majority of producers, it is an unfortunate and widespread fact that many producers who receive excellent premiums for their highest scoring lots are still losing money overall,” said Howe. “This is one reason behind the sobering reality that coffee production is increasingly untenable as a business model for many producers around the world. The current state of the industry often feels far removed from the healthy, and equitable, supply chain that we want to support.”

Sollenberger said that while a standalone Necessary-brand coffee shop is unlikely, the company hopes Necessary will stand alongside Passenger on shelves and cafe counters. The company’s latest Prince Street Cafe is a testing ground for this, both in terms of Necessary’s success in patrons’ cups but also for how the messaging is handled. Necessary is the house standard brand, and Passenger is featured as a by-the-cup option.

“This moved allowed us to show people that we stand behind these coffees every bit as much as we stand behind Passenger’s offerings,” said Howe. “It has very little to do with ‘quality’ and a lot to do with ‘the qualities’ we are looking for in the cup. By and large we think the specialty industry has not done an excellent job of meeting consumers where they are at, in a healthy way. Necessary allows us to do that, while allowing Passenger to retain its distinct identity.”

Howe also expects that it will only take a few short years before Necessary will be moving coffee in greater volumes than Passenger.

“Not only does this make complete sense, but it is wonderful,” said Howe. “The nature of coffee production is such that there will always be more coffees available that fit into the Necessary flavor profile. Coincidentally, these are also flavors that the vast majority of average coffee consumers prefer. If we can execute well on that, again, it only allows us to elevate Passenger, and execute more fully on Passenger’s goals. Both in terms of how we source coffees, but also the coffees we are able to present.”

[Editor’s note: This story has been updated to clarify the names of sources. Some quotes have been correctly attributed to Evan Howe.]

Howard Bryman

Howard Bryman is the associate editor of Daily Coffee News by Roast Magazine. He is based in Portland, Oregon.

Comment

3 Comments

Comments are closed.

But what is Necessary paying farmers on average? FOB at the least, and ideally farmgate?

Hey Cory! Great question…. but even that is a tricky one to answer. All of these coffees come to market through a Coop or producer group, so FOB and farm gate can be misleading. In short, the business model was written off of an FOB price of $2.50-2.75/pound (the market is currently hovering around $1.00 for quite some time now). In the case of the Burundi offering, that producer is paying the same for all cherries delivered to their washing station, so the farmers are getting paid the same as they would be for their microlot quality coffee (which happens to be the highest price paid for cherry in the country). In Colombia they are being paid based on quality. For the past year the Colombian coffee market has been around 700,000 Colombian Pesos per Carga of coffee (125 kg). We buy Passenger’s Keystone blend component for 1,400,000 Colombian Pesos per carga (price to the producer). The Necessary coffee from the same producers is purchased at 1,050,000 Colombian pesos per carga. As for Ethiopia, that is similar to Burundi in that the farmers are receiving the same price for the cherry whether it is being sold to Passenger or Necessary. That said, the FOB price differs, which means the Cooperative Union takes a larger margin on the higher quality coffee. Kata Muduga Union has a very transparent financial structure and this extra margin is used to pay down bank loans. After loans are paid 70% of the remaining margin is divided up amongst farmers based on how much cherry they delivered. Finally the remaining 30% is used for social projects: schools, roads, etc. Great question, Cory!

Thanks so much for this comprehensive info, David! I completely understand this is a complex topic, and FOB only tells a small piece of the story; I always prefer farmgate, specifically defined as money per bag in-the-farmers-hands (vs. primary or secondary coop), but that seems to be all too rare.

It’s heartening to know you have and are willing to share the specifics you do have. This seems to indicate roughly an 18% Return to Origin, which is definitely higher than the norm.

My biggest issue with much of the current narrative is that many companies say they are buying at “sustainable” or “ethical” at “livable prices” without giving any type of baseline what price they’re purchasing at– or giving consumers a benchmark (let alone with explanation, based on methodologies like ANKOR or True Price) for what is considered any of these adjectives.