Seasonality

The idea that a particular crop — in our case, coffee — is available and fresh for a particular portion of the year is long-ingrained in the specialty food and beverage industries.

Like all other fruit, coffee berries have a finite shelf life. Yet while most drupes are coveted primarily for their fleshy pulp, coffee is coveted for its seeds. Therefore, a green coffee’s freshness is related not only to its harvest time, but also to the time required for processing (i.e., removing the seeds from the fruits and preparing them for storage and transit), the time associated with international shipping, and the elongated (but not infinite) time spent in a warehouse or roastery, waiting to be roasted while still fresh.

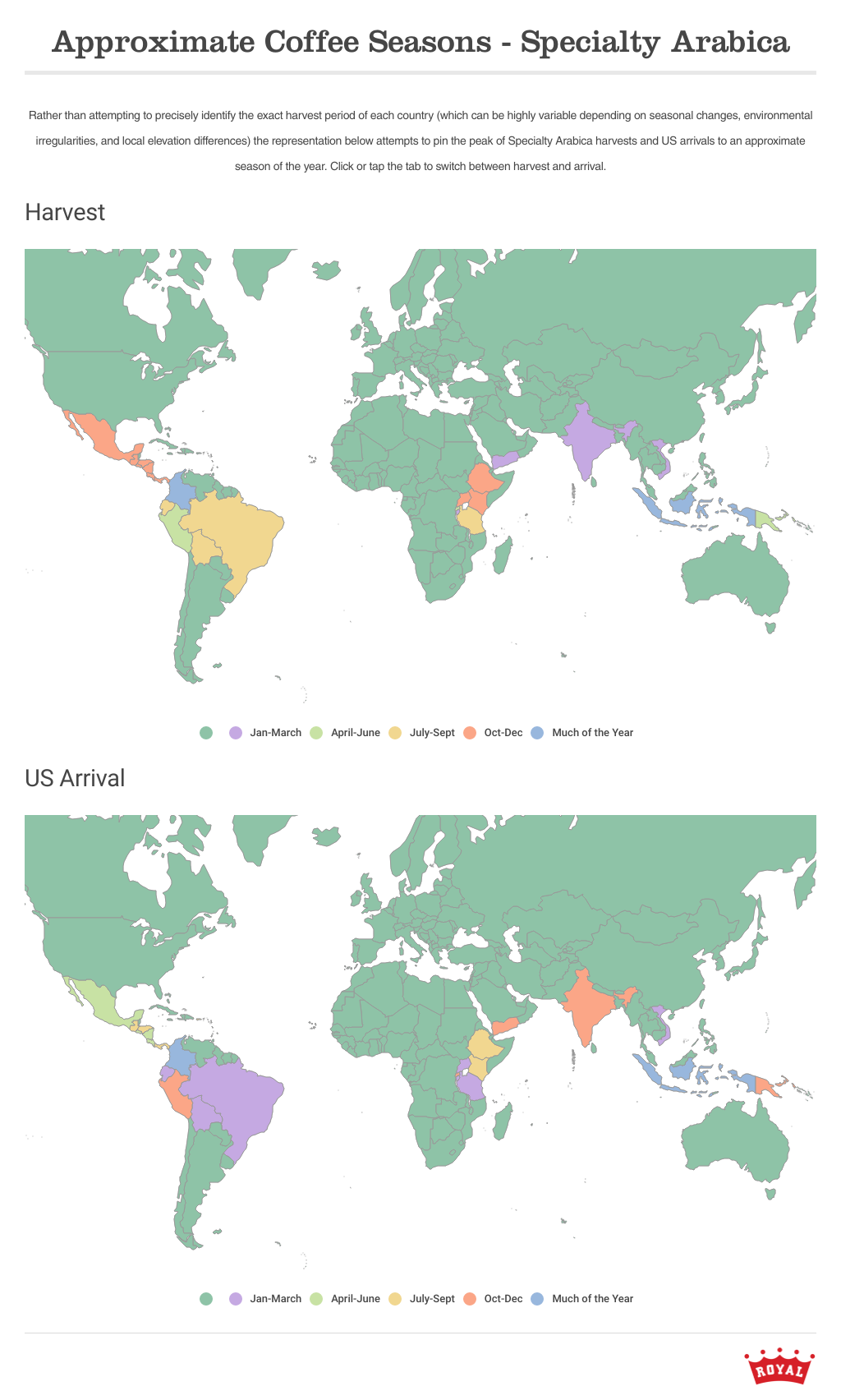

Six years and what feels like a lifetime ago, I penned a piece for DCN that attempted to explain and visualize typical destination arrival time frames from many coffee regions in the world. I even copied and pasted a large section of the article into my Green Coffee book.

Today, the whole thing is starting to look a little wrong to me. So what happened between then and now? The short answer is: everything.

What’s Changed?

In no particular order, there was an unprecedented global pandemic, ongoing shifts in global temperatures and climate widely acknowledged to be caused by human activity, and multiple dire humanitarian crises, not the least of which is an ongoing genocide in Gaza and broader violence across the Middle East.

Each of these phenomena affects us deeply as a human species far more deeply than they affect coffee, and I can’t tell you how many times in the last few years I’ve had to pause, breathe and remind myself that what I do in coffee matters little in a world that feels constantly set to flame. I can’t say how many times I’ve stopped in the middle of a piece of writing about coffee, looked around and not typed another word.

Yet one of the throughlines considering these phenomena is that what affects one of us affects us all. With that in mind, I do still want to talk about coffee, and how the world changing around us has altered the product we love.

Climate

Nowhere can the effects of climate be felt more acutely by coffee traders than in the C Market. Typically, global prices spike in September, as hot, dry weather hints that Brazilian coffeelands may be affected by drought. Then, sometime in October, eventually it rains, and the market relaxes.

This will not always be the case. The fluctuations of 2024’s have been magnified by bad weather in Vietnam. The global robusta market was so heavily bent by projected supply shortages that the price of arabica rose in parallel. We’ll see this, and phenomena like it, again.

One year, probably not so far in the future, the rains will fail. Later, drought may become the norm. The rapidly changing climate and the failing of the earth’s carbon sinks bode ominously for a climate future in which politicians and industry barons alike seem unwilling to bend to new planetary realities.

For many of us in the habit of buying coffee, climate-related issues tend to hit hardest in the wallet. Yet for those growing, harvesting, and processing the crop, climate’s impact can be all-encompassing. Once more, for those in the back: The effects of climate change most heavily impact those who are least responsible for its causes.

Not only must the farmer in Brazil, Vietnam, or elsewhere weather the fallout from decreased yields, they must also survive in an increasingly challenging and unpredictable physical environment. Ethical buyers should understand that the cost of their coffee must include considerations for adaptation for both coffee plants and their human custodians, and should pressure industries like petroleum, shipping and packaging for truly sustainable solutions to the problems they’ve started.

We’ve not yet fully felt a seismic shift in volumes and seasonality of coffee related to climate change. However, some cracks are beginning to show, if you know where to look. One big one is associated with the cost of coffee — often related to rain, drought or frost affecting its future availability. Based on commodity prices, large, sophisticated traders may opt to hold or release substantial volumes of coffee, affecting seasonality downstream.

Logistics

Supply chain delays became daily news fodder in 2020, and while there’s been a recovery of volume capacity at ports worldwide, small anomalies in availability of containers in certain ports can impact timelines far more than what we’d once expected.

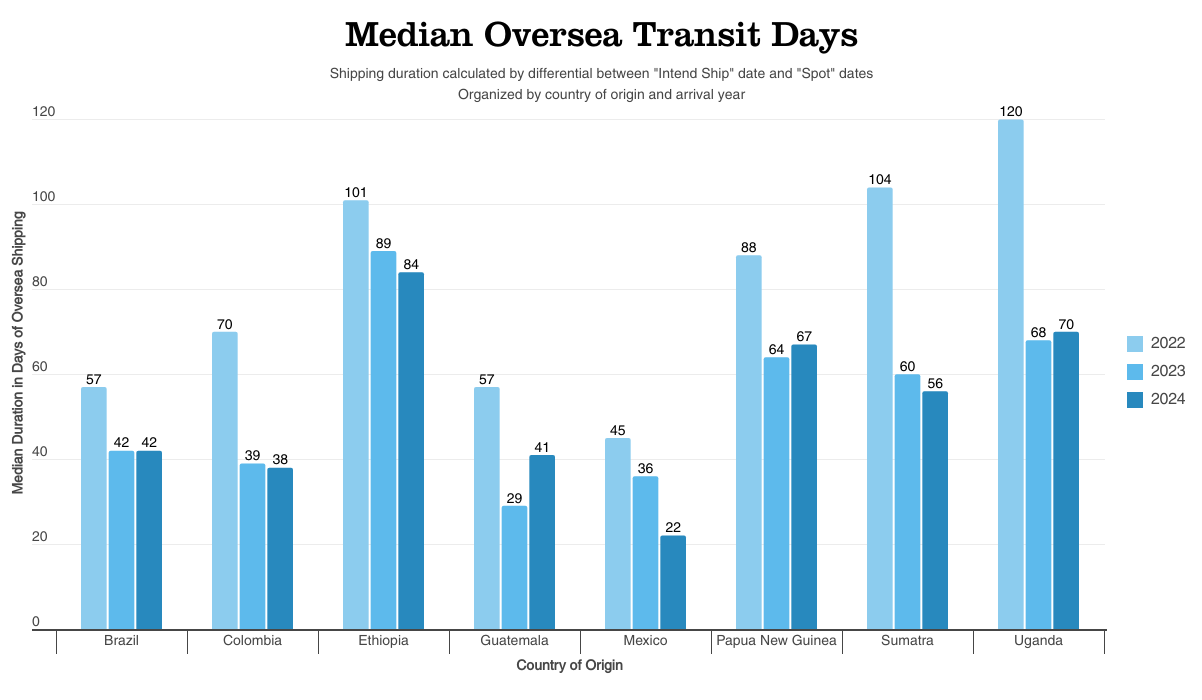

2022 will remain a year of infamy for coffee importers, as most were heavily impacted by shipping delays as future demand outpaced spot supply. Over-purchasing briefly became the norm as buyers scrambled to buy any coffee available at any cost. Weeks turned to months as labor and container shortages brought international shipping lines to their knees. We saw some coffees spend more than six months or more on the water.

As coffees arrived, early 2023 became a nightmare scenario for anyone who was on a buying spree in 2022. Interest rates skyrocketed causing spikes in the price of financing large quantities of coffee, and 2023’s crop became less expensive and more readily available — and more attractive to savvy buyers — than the aging stocks of 2022, which were left to wither and devalue in warehouses across the world.

Most green coffee traders slashed their 2023 purchasing volumes to compensate, hoping to move inventory from their warehouses bulging with older coffees. Some, small and large, didn’t survive, and the import industry consolidated.

Consolidation in the shipping industry also exacerbated supply snarls, as we saw markedly in Ethiopia this year. In the spring of 2024, after months of Israel’s catastrophic and disproportionate violence in the Gaza strip in retaliation for Hamas’ assault on October 7 of 2023, Yemen undertook a Palestinian solidarity campaign, disrupting shipping lanes through the Red Sea by firing missiles at container vessels.

In March, Maersk ended port calls, and the other major shipping line, run by MSC, picked up the slack. Internal estimates at Royal put the percentage of coffee exported from Djibouti by MSC at around 80% of total volume, a virtual monopoly. This only lasted until late June, when MSC announced that service calls would end to and from the port, amid the peak of the Ethiopian coffee export season. This effectively suspended service from the sole port of debarkation for one of the world’s preeminent coffee suppliers.

The situation in the Red Sea is less dire now than it was then, although the relative stability has taken a human toll in the form of indiscriminate bombing of Yemen by U.S. and UK forces. For anyone with the luxury of a 10,000-foot view, the cost of shipping Ethiopian coffees this year, as measured in human lives, has been difficult to stomach.

Case Studies

Ethiopia has been something of a bellwether for many of the concerns mentioned above, yet it has also been an example of foreign investments and currency exchange impacting the prices and availability of coffee.

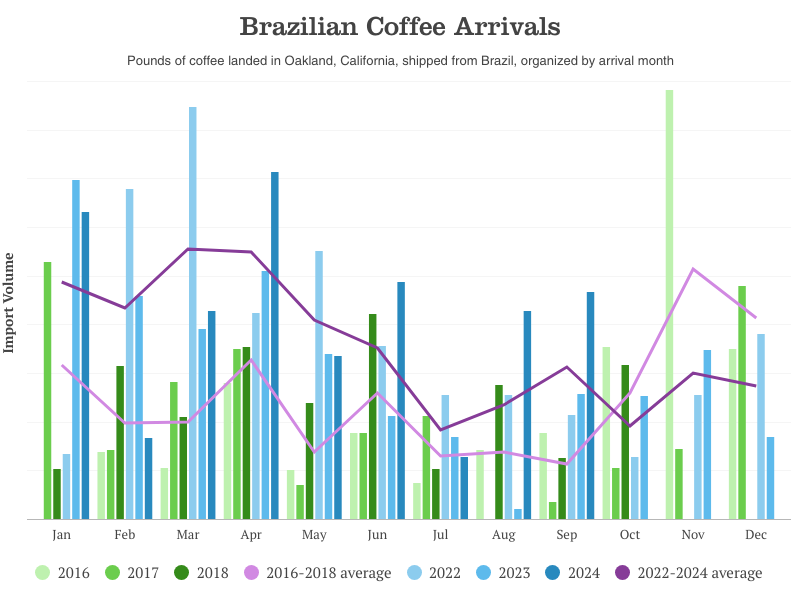

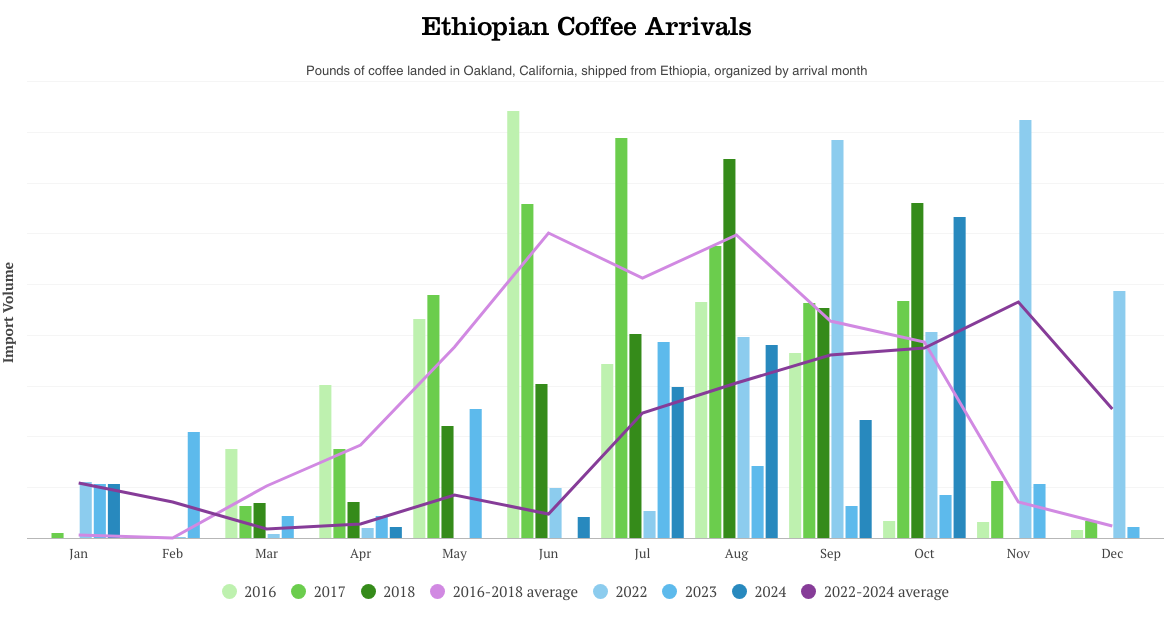

Pre-pandemic, Ethiopian arrival volumes to the U.S. had already been shifting, with coffee devanning in Royal’s warehouses nearly a month later in 2018 compared to 2016. At the time of the prior article’s publication, this was primarily blamed on isolated climate circumstances.

In 2022, Royal Coffee’s substantial arrival volumes peaked later in the calendar year than we’d ever seen, with massive bag counts landing as late as November and December, and a few ill-fated containers showing up as late as February 2023.

This year, as we resumed higher volume purchases after clearing 2022’s stocks, Royal managed to land a couple of lower grade coffees in Oakland as early as April, though the bulk of our top tier purchases were impacted by the Red Sea fiasco and mostly arrived in late September and October.

I’m not sure we’ll ever go back to the softer times of the 2010s, when June was a common expectation for peak seasonal Ethiopian arrivals. Since 2022, oversea transit times have only marginally improved when shipped from Djibouti, unlike other common ports of debarkation.

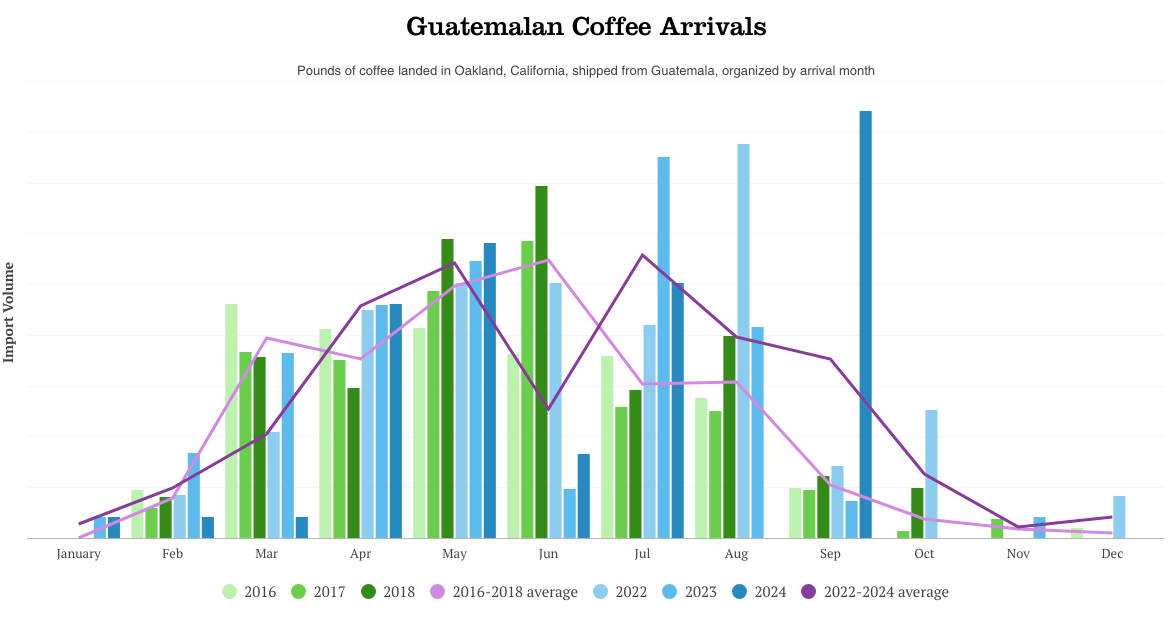

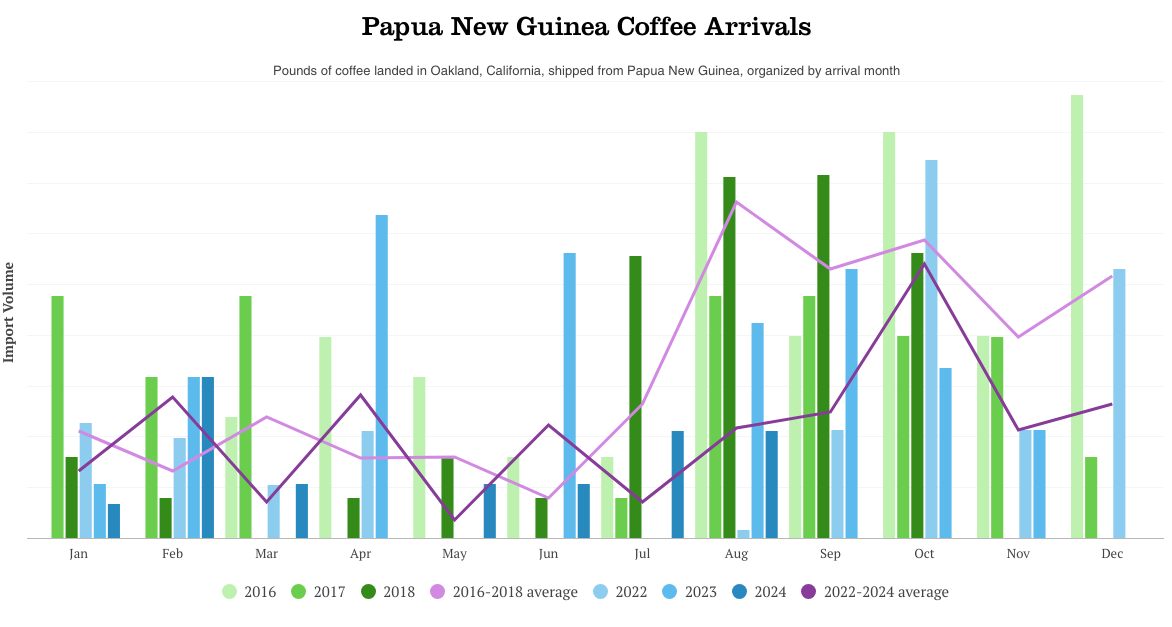

Other coffee producing countries with statistically significant volumes — and with which I had data to compare from 2018’s report — follow this overall delayed arrival trend in Royal Coffee’s imports, including Brazil, Guatemala, and Papua New Guinea.

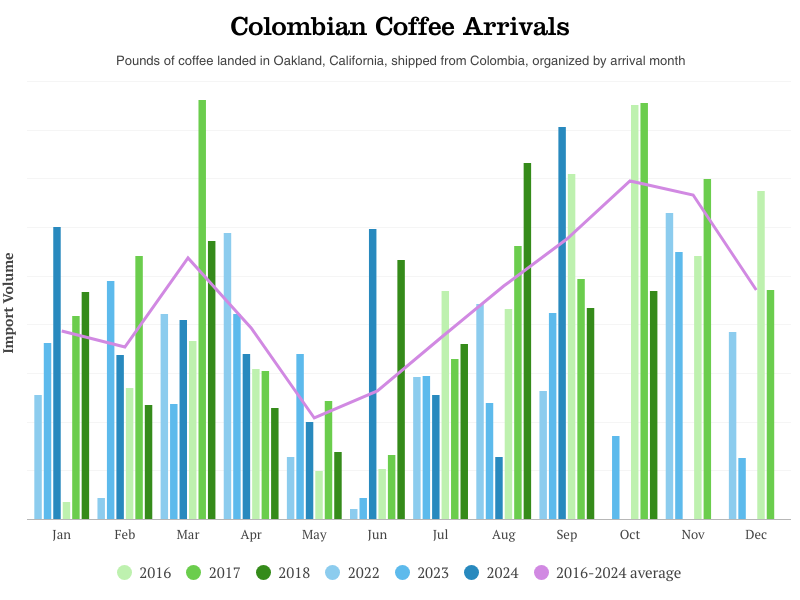

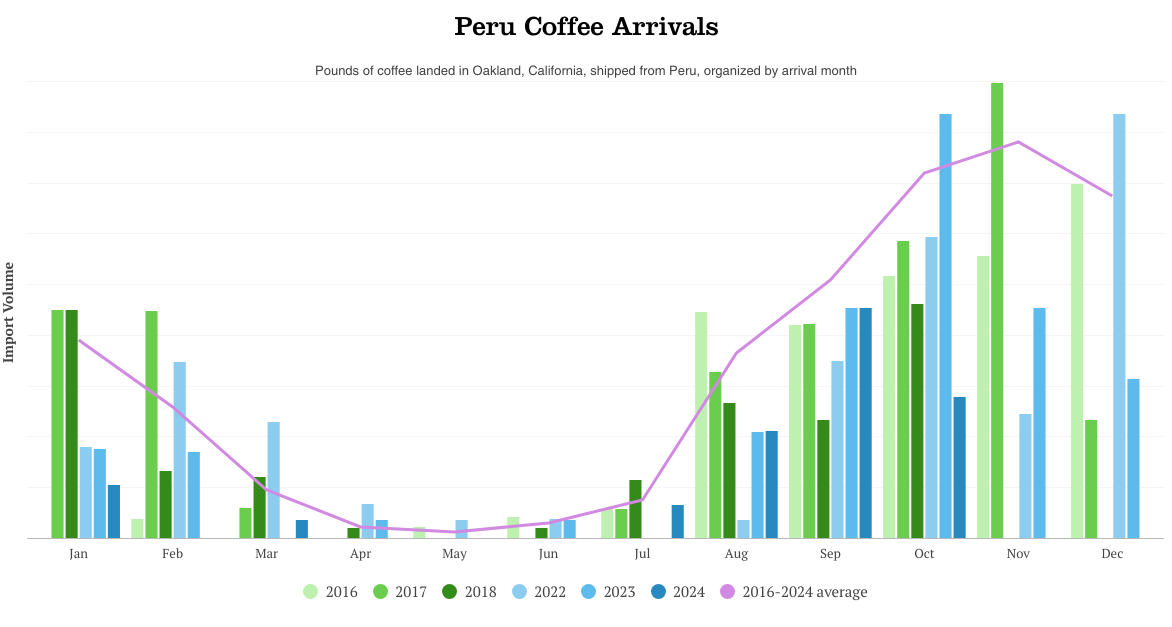

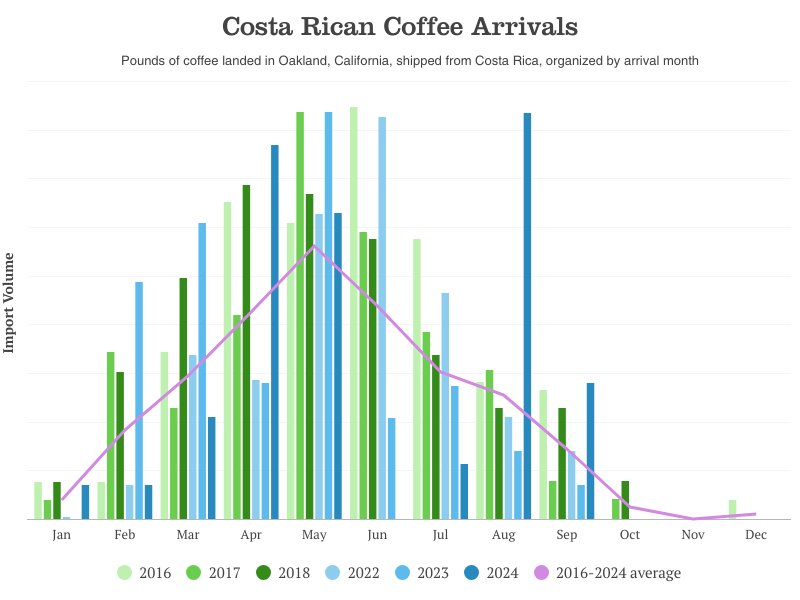

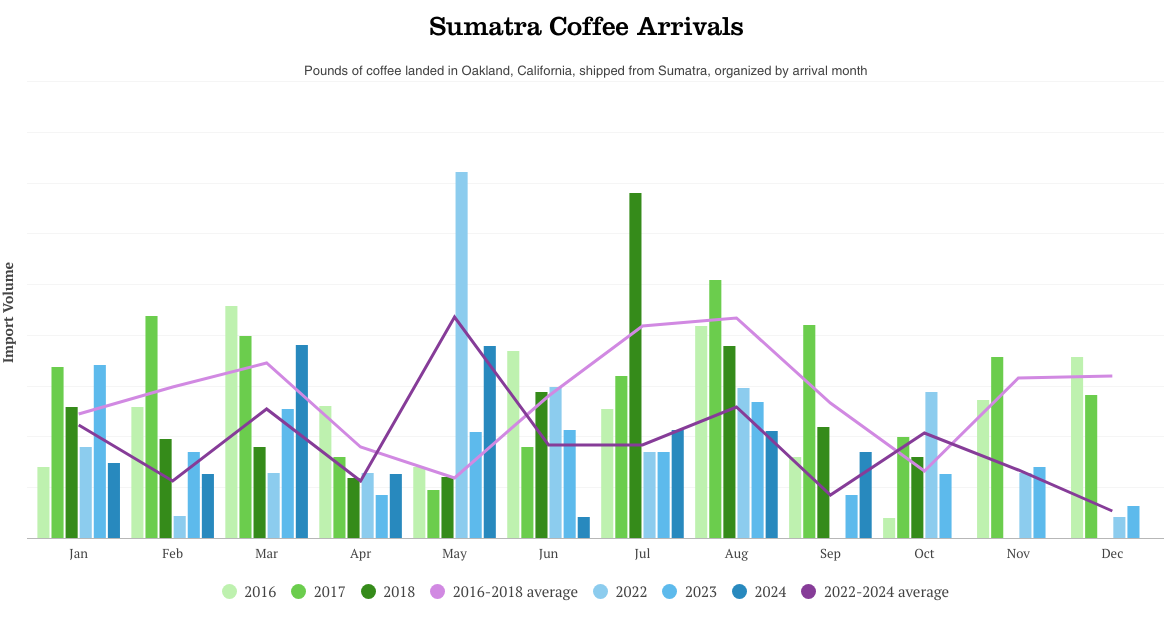

Costa Rica and Peru, however, seem somewhat unaffected. Sumatra and Colombia both appear to show seasonal shifts that defy expectation. With coffee available from both Indonesia and Colombia for so much of the year, it’s likely the most responsible explanation for these shifts is simply related to changes in our buying habits rather than harvest, availability or shipping delays.

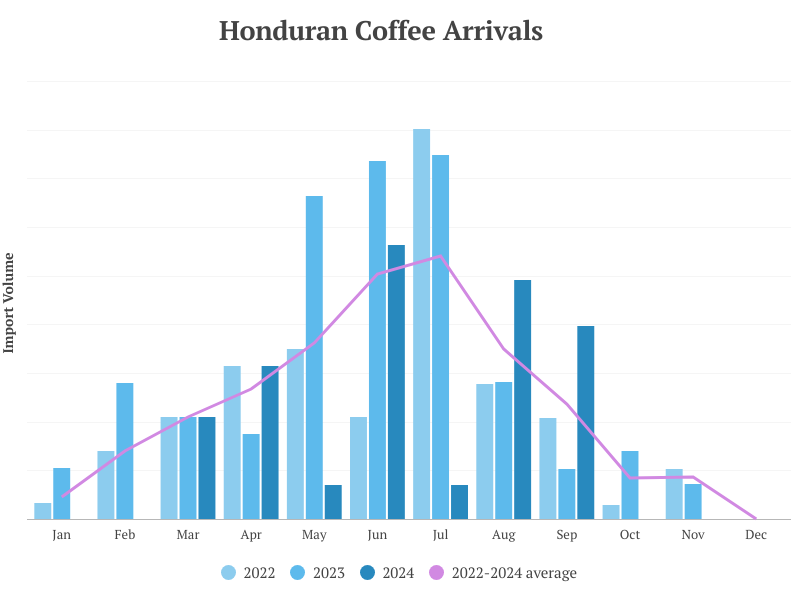

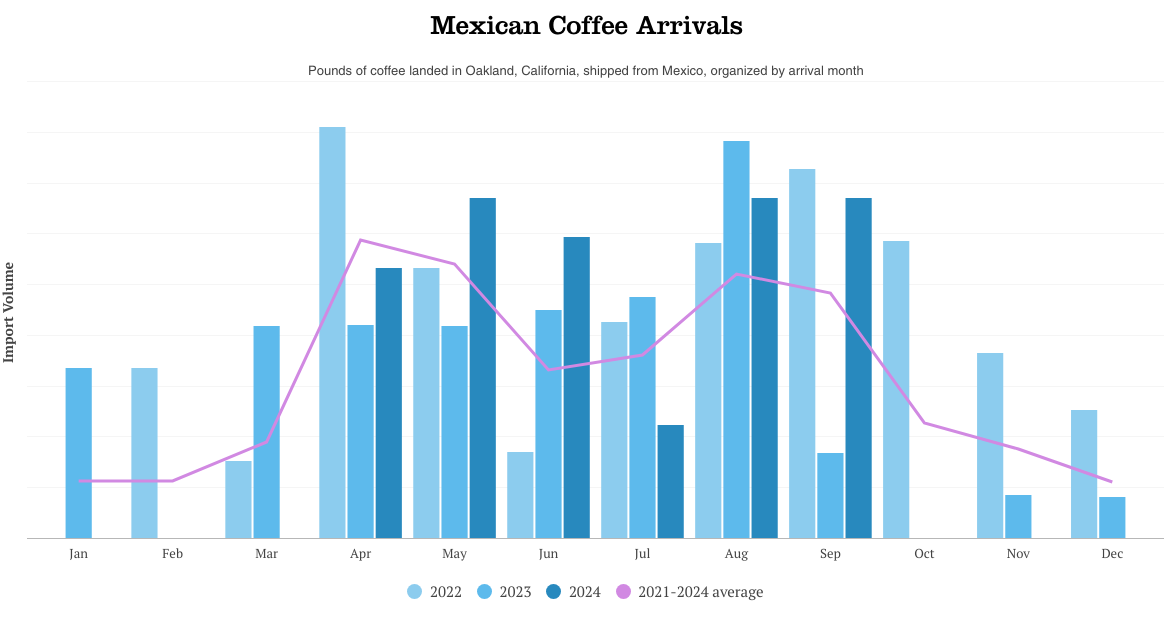

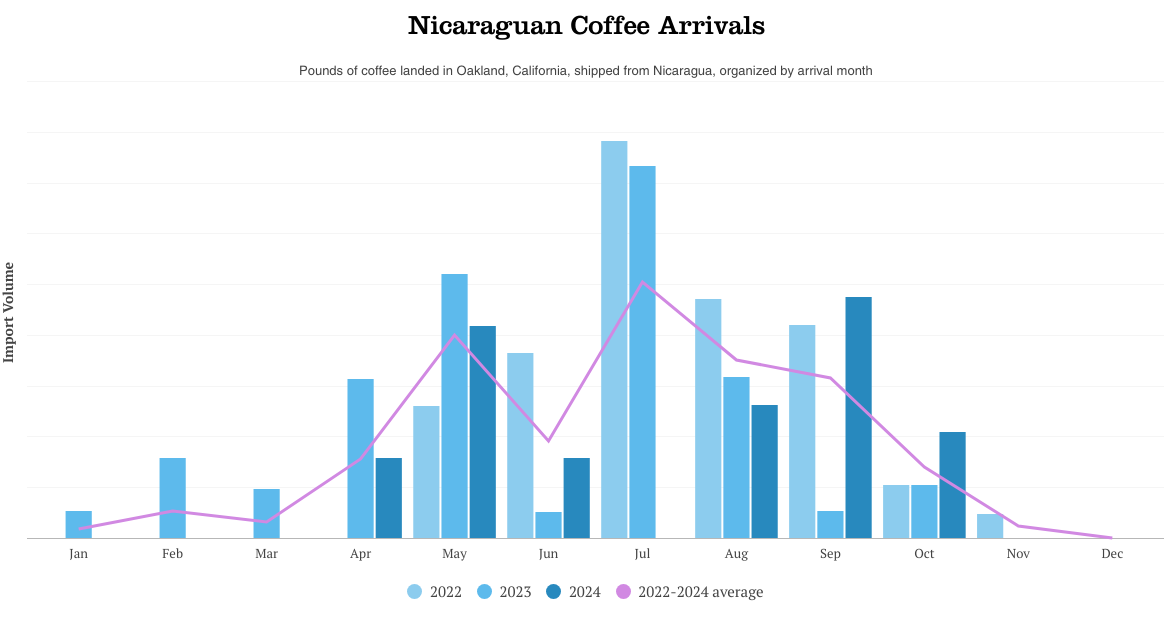

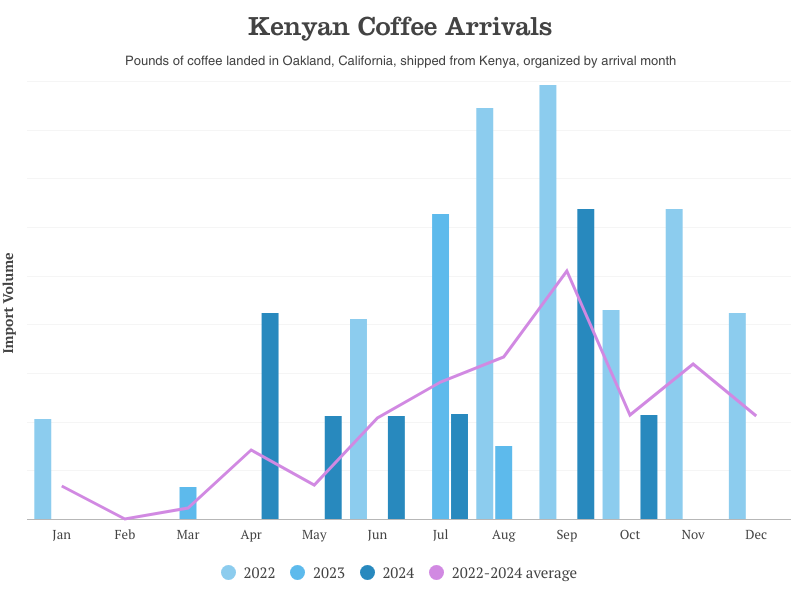

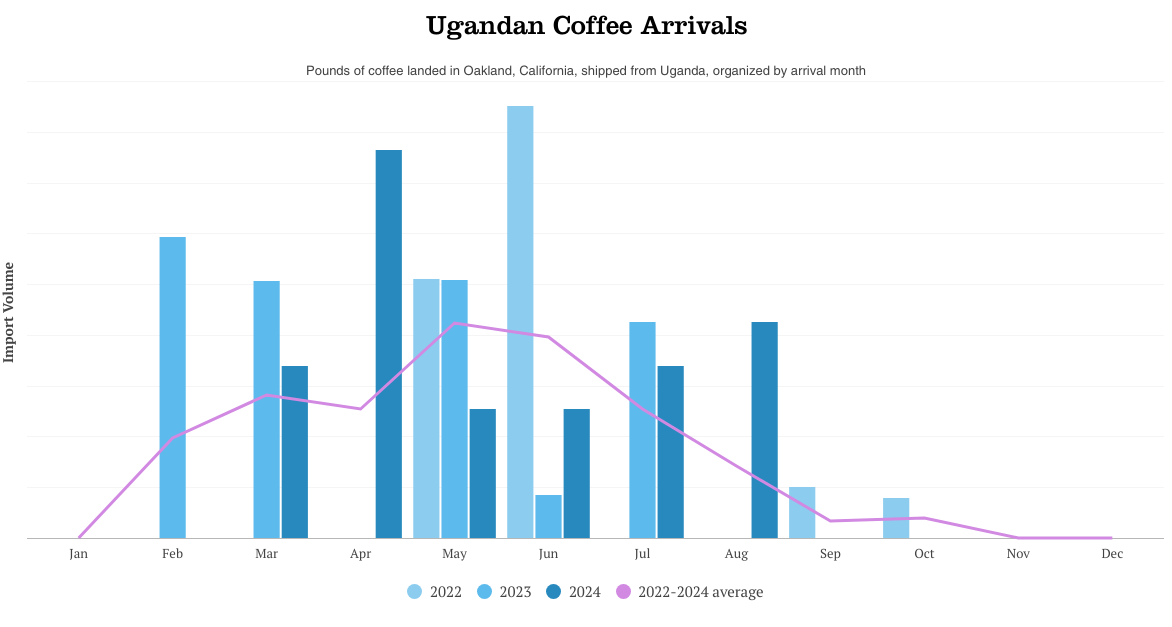

I’ve included some datasets from coffees that weren’t part of the 2018 survey, as well, which mostly display recent trends in arrivals. Again, these are limited to the coffees Royal Coffee has imported specifically to our warehouse here in Oakland, California, and are thus not necessarily reflective of transit times and arrivals in other areas of the world.

Subjective Seasonality

Seasonality, I’ve come to believe, is as much in the eye of the beholder as it is the result of any other complex or situational circumstances. Coffee harvest durations in most of the world can last for weeks, if not months, and drift based on regional climate shifts, labor availability and other forces.

Export and import may be expedited or delayed for myriad reasons, not the least of which are macroeconomic and socio-political in nature, and not necessarily related to coffee itself.

Inasmuch as coffee freshness remains a topic on the tongues of specialty coffee professionals, so too must the larger machinations of climate, geopolitics, economics and, I’d argue, equity and empathy.

As an industry, and as a collection of people on a complicated planet in unprecedented times, we may need to explore new and nuanced approaches to coffee freshness and seasonality.

Here are some more country-specific arrivals schedules:

[Publisher’s note: Daily Coffee News does not engage in sponsored content of any kind. All views or opinions expressed in this piece are those of the author/s, and not of Royal Coffee or Daily Coffee News.]

Chris Kornman

Chris Kornman is a coffee romantic and educator, and a quality specialist with a history of indiscreet coffee buying, roaster fires, ill-advised travel, and oversharing. He is the author of Green Coffee: A Guide for Roasters and Buyers and regularly contributes coffee-related disquisitions to publications worldwide.

Comment