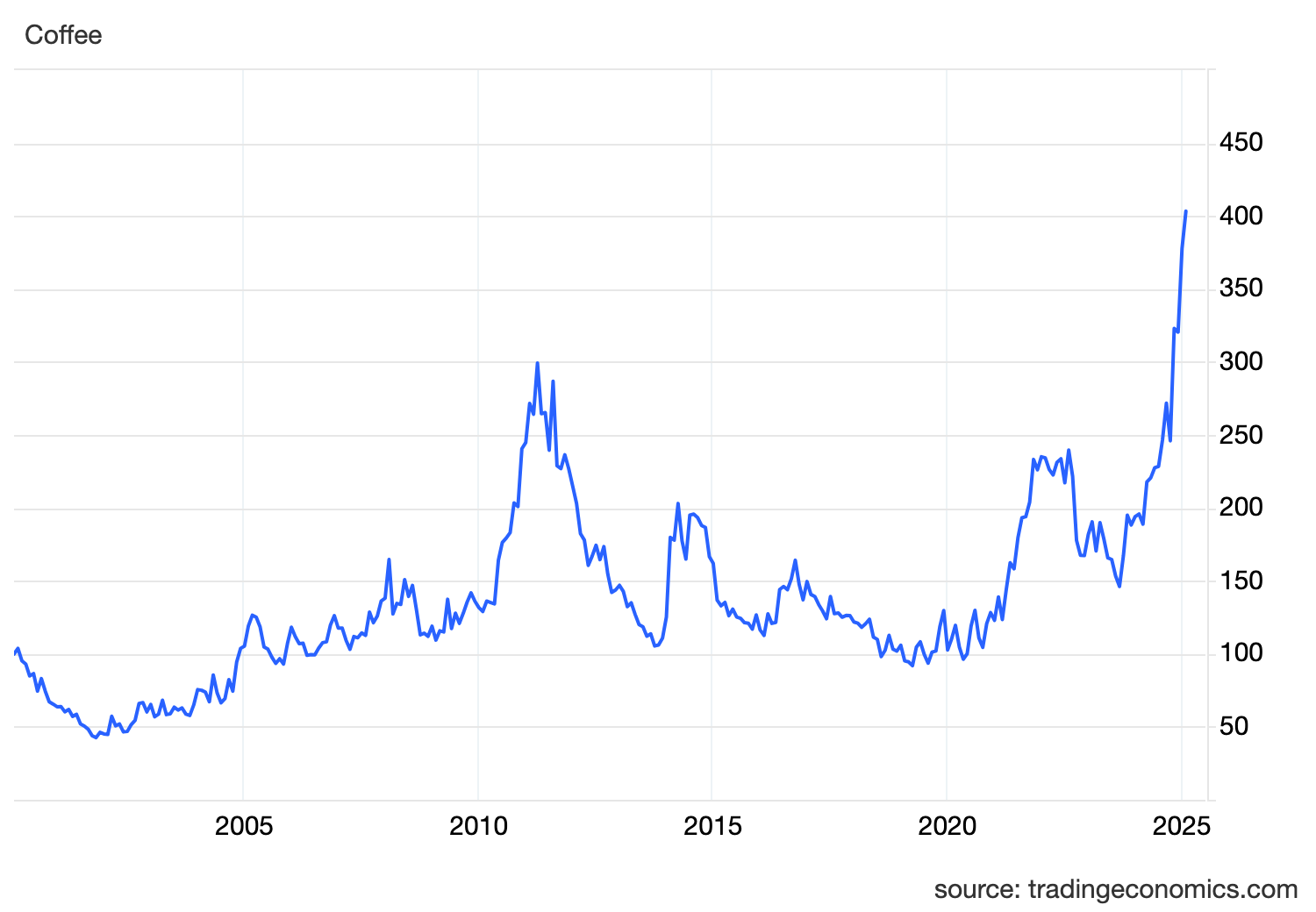

At the time of this writing, the near-futures coffee prices on the ICE exchange (a.k.a. the “C price”) was sitting at an all-time high of around US$4.03 per pound.

The relatively high price of coffee is the stuff of headlines in financial, mainstream and trade publications these days, which begs one fundamental question: What is the price of coffee?

For one person wandering alone in the coffee universe, the “price” may mean the cost of a vanilla latte at the coffee shop down the street; whereas, in another galaxy, the price may be associated with picked coffee cherries being loaded onto the bed of a truck.

In between those two wildly different manifestations of price in coffee, there are literally dozens of different price events — moments in which a price is set and agreed upon by multiple parties — in any seed-to-cup coffee chain.

Here are a few common examples: unprocessed coffee prices paid to farmers at post-harvest processing mills; baseline prices set by government agencies within producing countries, or by certification schemes such as Fairtrade; benchmark green coffee prices on various commodities markets; reference prices established by intergovernmental agencies such as the International Coffee Organization; “spot” prices, FOB prices or other identifiers used between traders and roasters; or retail prices of 12-ounce bags of coffee or a 12-pack of pods.

Yet for reasons unknown — except, perhaps, for New York City’s historical status as a gatekeeper of financial trade — much of the professional coffee world returns again and again to a single benchmark, commonly known as the “C price,” for coffee.

Despite being controversial, convoluted, broadly misunderstood and somewhat arbitrary, the single C price does provide some stability in the coffee trade, allowing for price “discovery” among market participants.

At the time of this writing, the C price reached all-time highs, hovering around US$4 per pound, commanding headlines throughout the mainstream media and drawing out hot takes from all kinds of market and industry analysts.

Typically overlooked in these conversations is even a compulsory explanation of the actual price reference. Where did this $4 figure come from? Who came up with it? And why is the coffee industry still using it?

Now seems as good a time as any for some clarification.

What Is the C Price for Coffee?

In simplest terms, the C price is a widely referenced benchmark price for green (unroasted) arabica coffees, which have historically been considered higher quality than robusta coffees. Often confused as a symbol for “Coffee” or “Commodity,” the “C” in the “C price” actually stands for “Centrals,” a vestige from when Central American coffee producers wanted to differentiate their coffees from those of Brazil.

Technically, the “C” today is a contract specification on green coffee futures contracts on the Intercontinental Exchange (ICE) in New York. It is through this ICE exchange — a financial tool by a private company, operating similar to a stock exchange — that the C price is established as a benchmark.

When traders participate in these futures contracts, they are essentially betting on what they believe the price of arabica coffee will be at a future date. Buyers and sellers agree to trade a specific amount of coffee for a set price at a later time. The outcome of this trading gives the broader coffee market a reference point — the so-called “C price.”

How Has the C Price Changed Over Time?

The conventional coffee market, like many other commodities markets, is cyclical. Historical data shows periods of sharp spikes followed by steep declines, reflecting changes in supply, demand, weather conditions and broader economic factors. In coffee and other agricultural goods, prices have also reflected a boom and bust cycle, in which high prices lead to more crop planting and production, which in turn may lead to lower prices.

Yet up until 1989, the coffee market was regulated by a series of International Coffee Agreements (ICA), which were intended to manage supply and maintain price stability through a quota system. Following the free market ideology of the Ronald Reagan administration, plus other ideological conflicts between key producing countries and key consuming countries, notably Brazil, the United States ultimately left the agreement.

The free market era since that time has been a period of extreme price volatility, as reflected in the C price. Here is a broad overview of some key periods in recent history.

- 1989-1994 and 2000-2004: After the collapse of the ICA in 1989, prices fell dramatically. Within two different periods, the market experienced a coffee “price crisis,” with prices remaining under $1.00 per pound for consecutive years.

- Early 2010s: Prices rose significantly due to coffee leaf rust disease that hampered coffee production throughout much of Mexico and Central and South America.

- 2017-2020: Prices reach another “crisis” period for producers, with the C price sinking to below $1 starting in early 2018.

- February, 2025: The C price for the first time exceeds $4.

The Role of Funds and Speculation in Volatility

Importantly, the C Price is not dictated solely by the physical exchange of coffee. Instead, it is heavily influenced by market participants who may never handle a single green or roasted coffee seed.

Hedge funds, large investment firms and individual speculators buy and sell coffee futures based on their market outlook or technical analysis. These speculative activities can amplify price movements, sometimes pushing the C price higher or lower than traditional supply-and-demand fundamentals would dictate.

An Arbitrary Marker

While the C price remains central to the global coffee trade, it is arguably somewhat arbitrary because it is shaped by futures traders and financial institutions, whose motivations can range from hedging risk to short-term profit.

This means that sudden changes in investor sentiment, rather than shifts in physical coffee supply or demand, can influence the price, creating uncertainty for producers and buyers alike.

Coffee prices, and specifically the “C price,” are certain to continue to capture headlines in 2025, especially in large consumer markets where traders and roasters may be paying higher prices for green coffees.

Yet it is critical to remember that the C price is a man-made goalpost in what many market participants consider to be the game of coffee. It is an artificial financial product, and not necessarily a reflection of the realities facing coffee farmers, roasters, consumers or other people who prize coffee as something more than a series of numbers and arrows.

Comments? Questions? News to share? Contact DCN’s editors here. For all the latest coffee industry news, subscribe to the DCN newsletter.

Related Posts

Nick Brown

Nick Brown is the editor of Daily Coffee News by Roast Magazine.

Comment