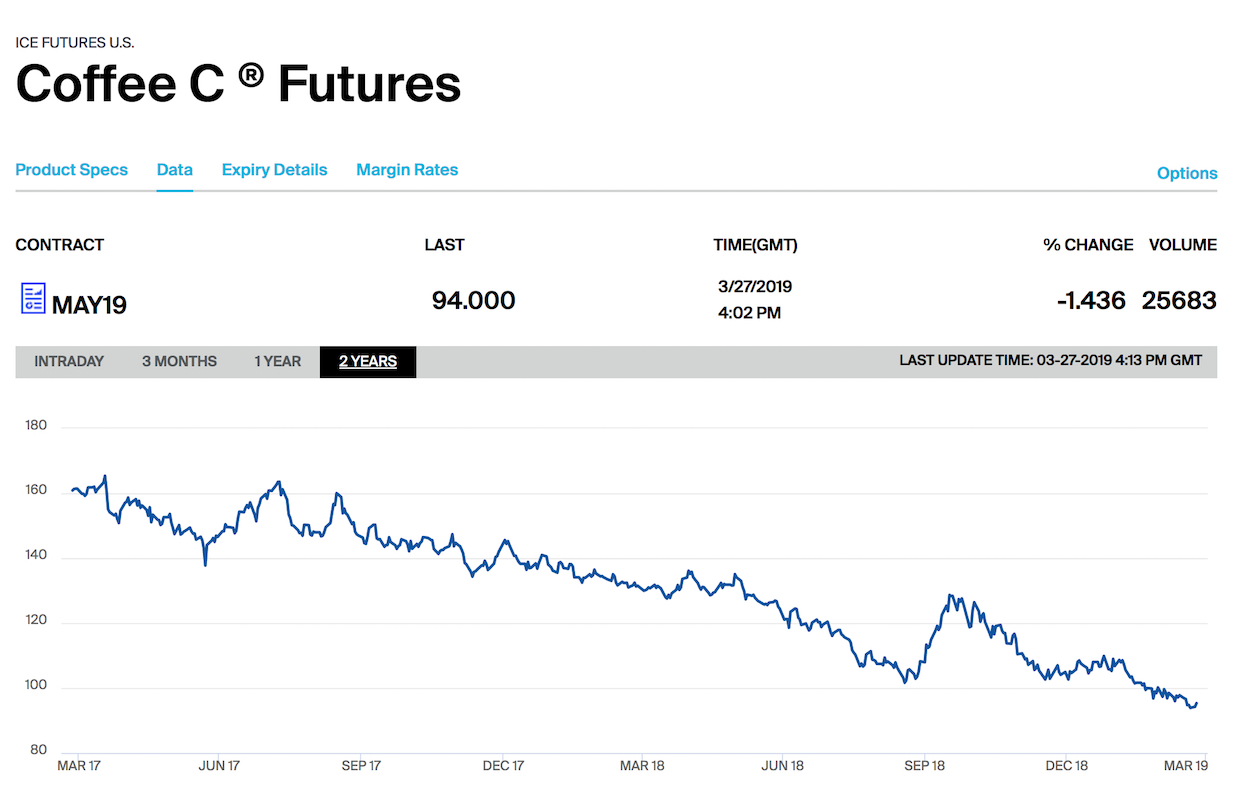

A screenshot showing the current ICE Coffee C Futures price for May contracts, plus the past two years of C price movement.

A consortium of major organizations representing coffee producers throughout the world has issued a sweeping condemnation of the global coffee industry as the “C price” for coffee sits at historic lows.

Without immediate action to supply better collective prices to the world’s approximately 25 million smallholder farmers, the coffee industry may likely be contributing to a widespread humanitarian crisis as coffee farmers abandon coffee in favor of illicit crops or migrate in search of better opportunities, the group warned today.

Thirteen organizations representing the World Coffee Producers Forum — including Colombia’s FNC, Africa’s AFCA, Latin America’s Promecafe, Brazil’s BSCA and the United States/Europe’s Specialty Coffee Association — have attached their name to a declaration calling for immediate action in response to low coffee prices.

The groups are specifically addressing the ICE futures price for commodity coffee — often called the “C Price” — which is widely used as a price discovery and reference tool in the creation of futures contracts for transactions of green coffee. Throughout the coffee sector, the C price serves as a benchmark that affects prices at virtually all levels of the coffee trade.

“Producing countries and other players are concerned that today’s ‘C’ contract is not the right price discovery mechanism and that by allowing the impoverishment of producers, the coffee industry is compromising its own future,” the consortium of producer groups wrote in yesterday’s declaration.

Earlier this month, the C price for May futures fell to USD $0.9465 per pound, its lowest level since 2006. As of this writing, the C price for May contracts was $0.9400. In fact, coffee prices have been in a dramatic slump through much of 2018 into 2019, repeating a downward cycle in a coffee commodities market that has been highly volatile in a free market period since 1989.

“Today’s ‘C’ futures contract was created as the price reference for a basket of mild arabica coffees of similar quality known as ‘Centrals,'” the group wrote. “Today, with several changes introduced over time, it is widely acknowledged that the ‘C’ futures contract based price does not cover production costs for most producers due to several factors, including speculation by hedge funds that do not understand or care about coffee.”

DCN identified coffee prices as the top story of 2018, as we published dozens of news pieces and columns on the ongoing coffee price crisis. Colombian coffee leaders have suggested that the country’s producers find a way to bypass the C market altogether to try to find prices that can meet costs of production. Last October, producer groups from more than 30 countries sent an open letter to some of the world’s largest coffee roasting companies calling for action.

In today’s letter, signed by many of the same producer-representing organizations, the consortium acknowledged past pleas to actors on the traditional roasting/consuming side of the industry.

“Coffee farmers from all over the world have been reaching out for years to the rest of the value chain hoping for a collective, constructive and realistic approach to secure the economic sustainability of producers,” the group wrote. “The response — unfortunately — has been very weak.”

Here is yesterday’s declaration from the World Coffee Producers forum consortium, in full:

DECLARATION OF THE COORDINATION GROUP OF THE WORLD COFFEE PRODUCERS FORUM

NAIROBI, KENYA

MARCH 26TH, 2019

Nairobi, March 26th, 2019.- The current social and economic crisis created by extremely low international coffee prices has come to a point where the coffee value chain -as a whole- cannot just continue talking about it, without taking serious and immediate action.

According to the International Coffee Organization ICO, about 25 million families -mostly smallholders- produce coffee in the world. Today, most of them cannot even cover their production costs and many of them cannot make a living for themselves and their families

The world drinks 1.4 billion cups of coffee every day (*) and consumers pay very high prices for them (from $3.12 in the U.S. to $4.60 in Shanghai to $ 6.24 in Copenhagen in 2018 (**)). In many cases, those prices are reached with the promise of the coffee being sustainable. However, the sustainability promise usually focuses only on two of its three aspects: environmental and social. Economic sustainability, the income of the farmers itself, has been neglected by the coffee value chain under the premise that “the market is the market” and we need to let it rule.

Today’s “C” futures contract was created as the price reference for a basket of mild arabica coffees of similar quality known as “Centrals”. Today, with several changes introduced over time, it is widely acknowledged that the “C” futures contract based price does not cover production costs for most producers due to several factors, including speculation by hedge funds that do not understand or care about coffee.

In 1982, the price of coffee fluctuated between US$1.18 and US$1.41 in the international market and a cup of coffee averaged US$ 1.10 in the United States; in 2018, the average price of a pound of arabica coffee in the international market averaged US$1.01. Furthermore, on March 22nd, 2019, the price closed below US$0.95. Coffee producers have lost more than 80% of their purchase capacity in the last few decades.

The current pauperization process of coffee producers is destroying the very social fabric in the rural areas of more than 40 countries in Africa, Asia and Latin America, leading to increased criminality in producing nations, more poverty in the cities, and massive migrations towards the United States and Europe. In some countries, the current crisis has become an incentive to shift to illegal crops because farmers cannot make a living from coffee alone.

Quality and availability are also threatened. Producers who stay in coffee will not be able to afford the proper care of their farms and their coffee which leads to improper fertilization and care of the trees, affects quality and deprives consumers the diversity that they enjoy today. Adaptation and mitigation of the effects of climate change are other burdens that falls on the shoulders of producers.

Producing countries and other players are concerned that today’s “C” contract is not the right price discovery mechanism and that by allowing the impoverishment of producers, the coffee industry is compromising its own future.

The current economic sustainability crisis of coffee producers needs to be addressed immediately before it becomes a humanitarian crisis. An approach based on the principle of co-responsibility and total transparency must be implemented to ensure that all the links of the value chain are profitable and healthy. Even if a coffee results in a great beverage, if it does so at the cost of the dignity, value or well being of the people and the land involve, it cannot truly be a sustainable coffee. ICE cannot be absent in this discussion.

Coffee farmers from all over the world have been reaching out for years to the rest of the value chain hoping for a collective, constructive and realistic approach to secure the economic sustainability of producers. The response -unfortunately- has been very weak.

When it comes to economic sustainability of coffee producers, it is clear:

¡NO ACTION IS NOT AN OPTION!

* Source: International Coffee Organization

** Source: Statista

ACRAM – Agence des Cafés Robusta d’Afrique et Madagascar, Cameroun, Centrafrique, Côte d’Ivoire, Gabon, Madagascar, RDC, Togo

AFCA – African Fine Coffees Association: Burundi, Cameroun, DR Congo, Ethiopia, Ghana, Kenya, Malawi, Rwanda, South Africa, Tanzania, Uganda, Zambia, Zimbabwe

AMECAFE – Asociación Mexicana de la Cadena del Café

ANACAFE – Asociación Nacional del Café Guatemala

BSCA – Brazilian Specialty Coffees Association

CNC – Conselho Nacional do Café – Brazil

CONAPROCAFE – Coalición Nacional de Organizaciones de Productores de Café – México

FNC – Federación Nacional de Cafeteros de Colombia

IACO – Inter-African Coffee Organization

India Coffee Trust

PROMECAFE

México, Guatemala, Honduras, El Salvador, Nicaragua, Costa Rica, Panamá, Perú, República Dominicana, Jamaica

SCA – Specialty Coffee Association USA

VICOFA – Vietnam Coffee and Cocoa Association

Nick Brown

Nick Brown is the editor of Daily Coffee News by Roast Magazine.

Comment

6 Comments

Comments are closed.

Groundhog Day! How many times over the past thirty years have we been here? And nothing changes (except the institution of Fair Trade pricing, which at least provides a decent minimum during the hard times). The C price used to serve a function for large commodity coffee companies trying to get a handle on prices in the future for planning purposes. But it has turned into a typically greed-driven speculative platform that has nothing to do with the cost of growing and processing coffee. Imagine, roasters and retailers, if you were told what your prices should be unrelated to your business costs and a reasonable profit? Oh, but it is a rare roaster or retailer who puts him or herself in the shoes of the farmer. Our partners, indeed.

Specialty coffee is supposed to be…special. Get off the C price! How can you sell coffee as if it were fine wine (read your labels) but pay as if it was swill?

Well said!

Yes, we have been here before, repeatedly. Past attempts to raise or at least stabilize the price of coffee have failed. The C price is only a “discovery” price for fairly good coffee. At my roastery, we use better coffee and pay more for it, and my costs for green coffee have changed very little over the last few years. I can’t see any governmental or private body somehow being able to get around C for most coffee; so much money is involved at ICE. Quota system? It can’t be revived. The only solution, I think, is to get more people to drink better quality coffee. I’ll go over this ground in a talk at the SCA on Sunday, Apr. 14.

Since the “C” price is for mass produced little care taken for quality low grade stuff, and since quality carefully cultivated and produced coffees are a different product altogether, WHY is the “C price even held as a standard?

Do folks expect to drive Mercedes quality whilst paying Chevy prices? I don’t think so. Lots of folks are content with Chevrolet quality and pay for it. Those who want Mercedes quality undertand they must pay for the extra value sold under that marque. And no one seems to have a problem with that.

I don’t really know what margins above “C” prices the importers dedicated to quality are using as they negotiate prices. I know they also add value along the chain, and thus they add price. I’m fine with that. I do not have the time to go traipsling off to Timbuktu to ferret out that remarkable microlot, or even the container full of 90 scoring Estate coffees, so am happy to leave the ferreting and arranging to these good folks. They di it amazingly well. I seriously doubt “C” pricing figures significantly into their price to me. I know the quality i seek, and have a sense of the value for which I pay some premium. As I evaluate each sample objectively and decide which ones I want, then price to me becomes part of the equation that must balance before I drop the hammer and say GO.

If I miss, pay too much for coffee that does not play well in MY market, I can belly ache all I want to, but ultimately it becoms a learning experience. Sometimes that equation will land me on the “I paid too much for that coffee for what it was….. ” and get stuck with it. A ten percent blender? Maybe… calibration coffee? More likely. What not to buy in future at any price? Nearly certain.

But HOW to break the chain that the commodity mechanism has fashioned for itself, and now has linked it so strongly to what WE deal in? The key will be to build a NEW structure that addresses the relevant issues. But starting with the “C” price is NOT the answer. Leave that to the “fill the holds of the cargo ships” stuff. different stuff entirely.

It’s always popular to blame “evil speculators”. But speculators are just as happy to long the price as short, they don’t determine basic supply and demand. When the industry is about to dump a record off-year crop into an already glutted market, what do they expect to happen to the price?

The world is awash with coffee, and the price isn’t going to change until production comes back in line with demand. No amount of letter-writing is going to change that basic economic reality.

Totally agree with Owen, the C market dies not make the market it just reflects and exacerbates direction, at times. If the C market has any blame to shoulder it is that it has provided a useful scapegoat for those unwilling to address supply and demand realities and the intransigence of some supply bases not to diversify, despite poor sustainability metrics on an ongoing basis.

Finally, differentials determine the reference point between real coffee and the futures price; it is the responsibility of all players to ensure that this reflects a fair and equitable price for the coffee delivered.