Starbucks has a whopping 40% share of the U.S. coffee shop market, according to World Coffee Portal’s 2020 U.S. coffee shop market report.

Despite market reports year after year after year suggesting that the higher-end specialty coffee segment has the most opportunity for growth and increased market share in the United States, the U.S. coffee landscape is actually being increasingly overrun by large chains.

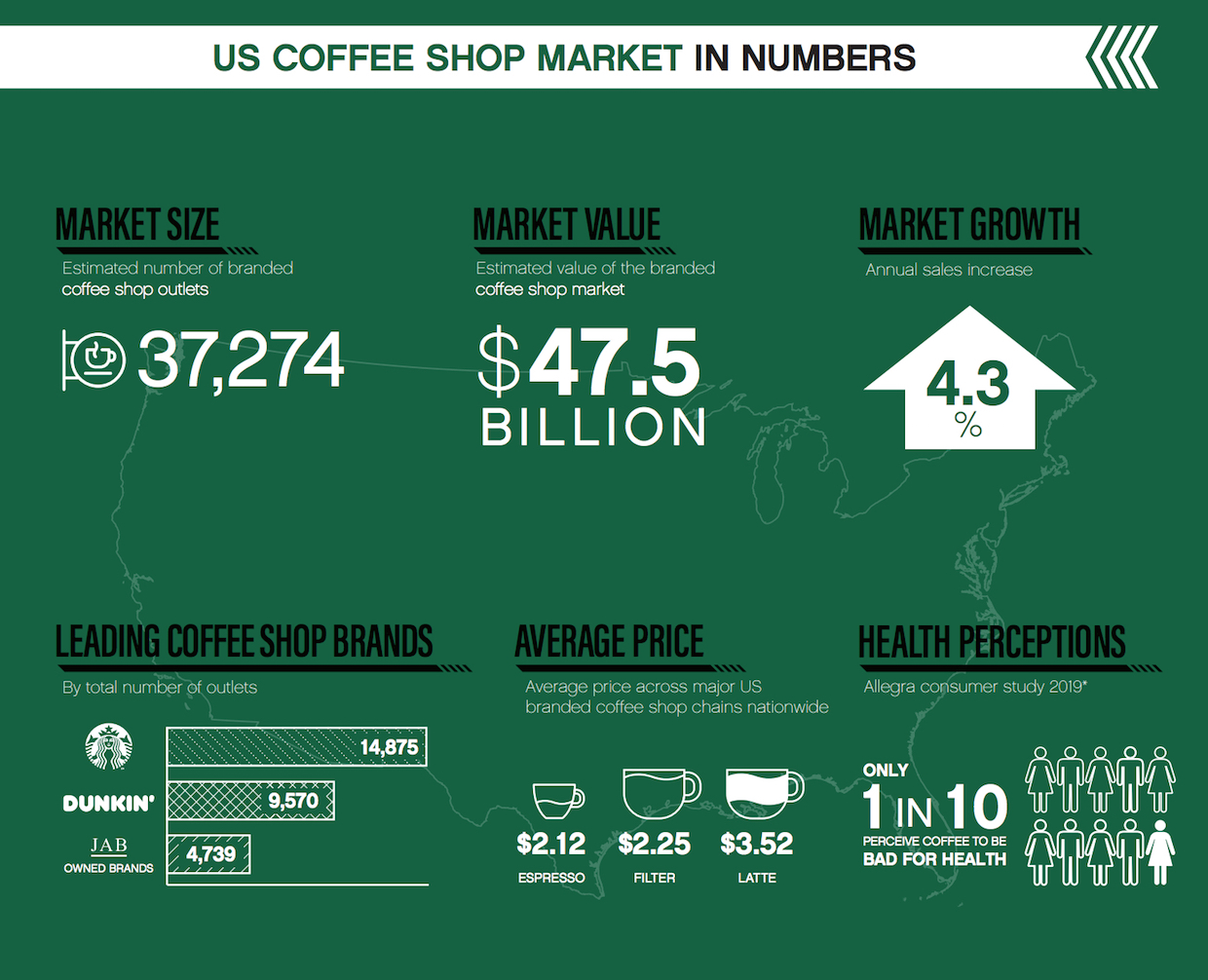

Market research and event firm Allegra’s World Coffee Portal has released its annual report on the estimated $47.5 billion U.S. coffee shop market, which showed 3.3% growth to reach 37,274 branded coffee shops and coffee-focused restaurants over the past 12 months.

Perhaps the report’s most shocking finding is that Starbucks and Dunkin’ accounted for 80% of the new store openings in the U.S. over the past year.

World Coffee Portal conducted 5,000 surveys with U.S. consumers, and more than 100 interviews, consultations and surveys with coffee industry leaders to compile the report. [Disclosure: A representative of Daily Coffee News took part in one of these surveys.]

In addition to the 3.3% outlet growth, total sales growth was clocked at 4.3%. Chains represented the largest growing segment, with 3.9% more shops over the past year. Starbucks maintains a whopping 40% share of the U.S. coffee shop market, with 14,875 stores and a net increase of 585 stores.

A Dunkin’ store in Quincy, Massachusetts. File photo. Dunkin’ now maintains a 26% share of the U.S. coffee shop market, according to the 2020 report.

With 9,570 stores, including 309 new stores (net) over the past 12 months, Dunkin’ maintains its place as the second largest chain, representing a 26% market share. JAB Holding-owned brands — the largest of which in the U.S. are Panera, Peet’s and Caribou — now operate more than 4,700 U.S. coffee-focused shops.

Approximately 78% percent of U.S. coffee shops are now either Starbucks locations, Dunkin’ locations, or JAB brand locations.

Despite these realities, the industry leaders interviewed identified growth in the specialty coffee segment as the most important consumer trend affecting the market. At 80% over the past 12 months, cold brew was identified as the fastest-growing coffee shop product. The report also identified younger consumers (under 30s) as the most influential on the coffee shop market, as they were found most likely to have increased their coffee shop visits over the past 12 months.

World Coffee Portal said industry leaders were collectively “cautiously optimistic” about continued coffee shop growth, while the group predicts a compound annual growth rate of 2.3% by 2024.

“Growth will be concentrated among the largest chains and most successful boutique 5th Wave operators,” the group said, referring to its own categorizations of coffee shop types. “However, the possibility of a wider economic downturn poses a threat across the entire segment, particularly those chains that fail to differentiate themselves amid intense market competition and rising property costs.”

Allegra World Coffee Portal is selling the full Project Cafe USA 2020 report here.

Nick Brown

Nick Brown is the editor of Daily Coffee News by Roast Magazine.

Comment

2 Comments

Comments are closed.

This is depressing.

It is very good