As the Covid-19 pandemic wears on, an analysis of roasted, bagged, specialty coffee prices has shown a second month of declines, particularly at the highest price points.

A recent report from Square and the Specialty Coffee Association documented several qualitative changes in the specialty coffee market in the wake of the COVID-19 pandemic, including an increase in curbside or pickup purchases and more delivery options. To further monitor the evolving effects of the pandemic on coffee business activities and retail prices, we have been tracking roasted specialty coffee retail prices and other changes.

Following the consistent sample of North American Specialty Coffee Retail Price Index (SCRPI) roasters provides data that can illuminate month-to-month market adjustments as the pandemic unfolds.

A review of the 57 SCRPI roaster websites in the last week of May revealed several qualitative adjustments to roaster and cafe operations:

- Four roasters removed COVID-19 references from their websites, while three added announcements to describe new developments.

- One of the three roasters that closed in April re-opened in May.

- Two of the several cafes that closed in April re-opened in May.

- Three cafes make announcements that emphasize health and safety practices.

- Two roasters offer customers brewing advice as they transition to more in-home consumption.

- Five companies are running barista/employee support programs.

- Another five companies have active community engagement programs.

Many of these observations foreshadow a slow return to a new normal for specialty coffee roasters and cafes across North America.

The most interesting observation from May relates to the different retail pricing dynamics at the upper and lower ends of the specialty market.

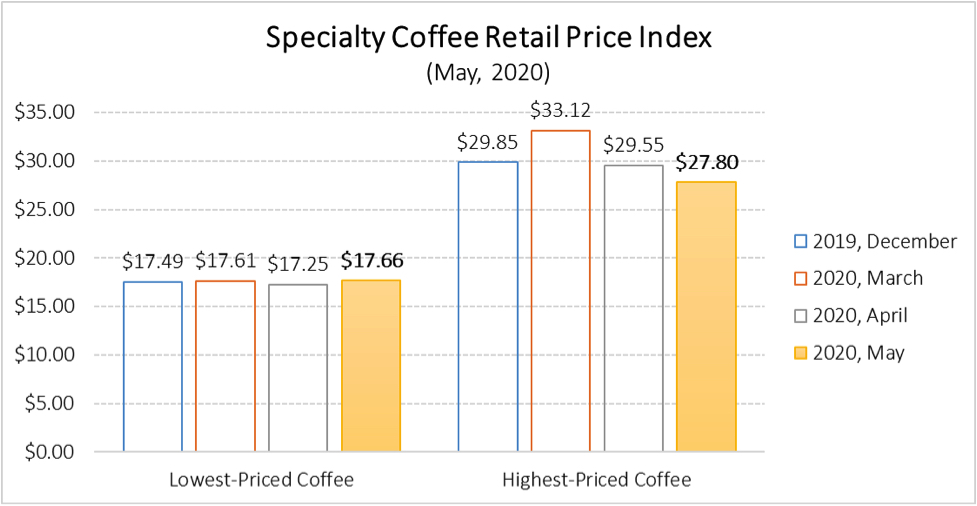

After falling 7.7% in April, retail prices for roasted specialty coffees continued to decline in May. Roughly two months into the global pandemic, prices are down 10.4%. The full brunt of this two-month decline is felt at the upper end of the market. The average of the lowest prices charged on SCRPI websites has risen 0.3% to $17.66 per roasted pound. At the upper end of the market, however, the average of the highest online prices has fallen 16.1% to $27.80.

Between the end of March and the end of May, there was considerable stability at the lower end of the market, with the lowest prices remaining unchanged in 41 online stores. The remaining SCRPI roasters split between price increases and decreases, with the average of five price decreases (-$1.56) exceeding the average of nine price increases (+$0.69).

At the upper end of the specialty coffee market, the highest online prices remained unchanged between March and May in 20 online stores. In 22 cases, the highest-priced coffees decreased by an average of $17.55 per roasted pound.

This reflects an ongoing “retirement without replacement” of many fancy coffees. In three online stores, the highest priced coffees declined by more than $50 per pound. In another three stores, the decline was between $20 and $50 per pound, while two other stores had declines between $10 and $20. In 13 other cases, the highest-priced coffees increased by an average of $5.85 per roasted pound. The price increases were more than $10 in only two cases.

Although it is very early in what will be a long-term adjustment process, we are beginning to see trends that suggest that the upper and lower end of the specialty coffee market are reacting differently to the COVID-19 pandemic.

The relative stability at the lower end of the online market seems to confirm beliefs about a general price inelasticity of coffee demand. At the same time, the apparent movement away from high-priced competition grade coffees is concerning when we consider that these coffees are market drivers and critical differentiators for producers and roasters alike.

We will continue to monitor these developments in the coming months.

Peter Roberts and Kayla Bellman

Peter Roberts and Kayla Bellman are part of the team that runs the Transparent Trade Coffee program. Peter is the Emory University professor who founded Transparent Trade Coffee and the Specialty Coffee Transaction Guide. Kayla is a graduate of Emory University’s Master’s in Development Practice program, and a long-time Transparent Trade Coffee research assistant.

Comment

4 Comments

Comments are closed.

We don’t understand how you people keep on playing with prices of coffee. Do you adjust the consumer prices as well? Do you consider the prices of farm inputs which are skyrocketing?

@Paul Muigo

This data IS about consumer prices, and I don’t believe there is any “playing” evidenced here.

This data shows that less very high-end, expensive coffees are being offered on websites right now. This of course makes perfect sense as in turbulent economic times it may appear insensitive to be offering $50/6oz tins of auction lot geshas. And if they go unsold within a narrow roast freshness window the loss is greater.

The fact that the cheapest of these specialty options still averaged a respectable $17/lb and actually increased slightly is a good sign for the whole industry.

Perhaps the newly unemployed have come to the conclusion that expensive coffee is just expensive coffee.

So interested in such production for the local farmers.

Iam impressed to purchase each coffee maker, roaster grinder. How can we arranged to negociate for trades.